zag73

Distinguished Member

- Joined

- Jan 10, 2015

- Messages

- 1,367

- Reaction score

- 917

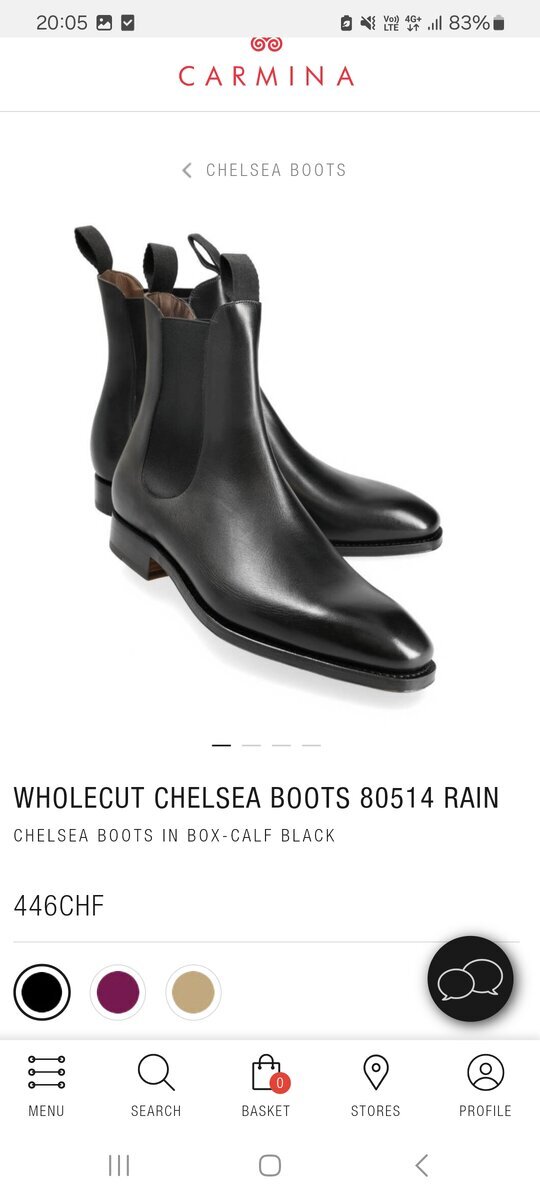

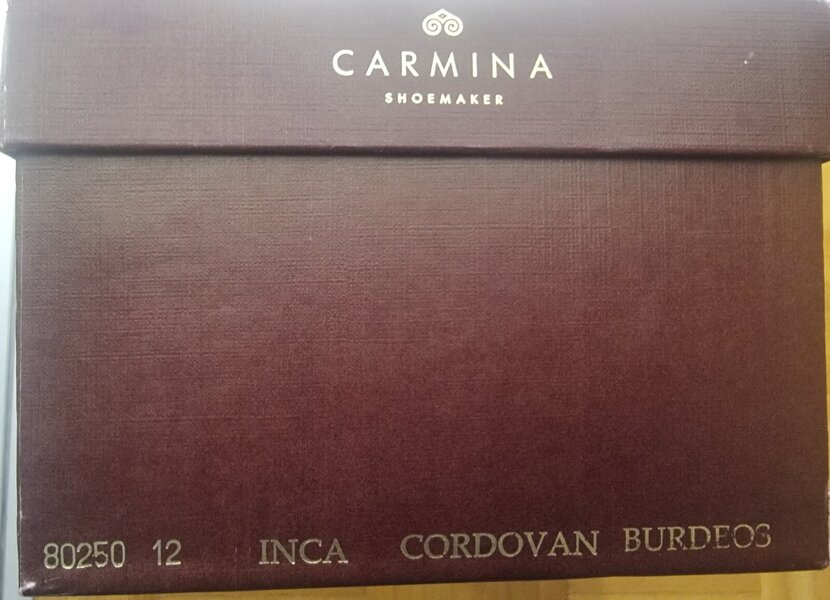

The whole situation is a bit weird. When I spoke to DHL, they suggested that if we bought a product in the EU that originated completely from within the EU, we should just pay the local tax and that’s it. I think companies are still finding their way.You shouldn’t have to if you paid for the shoes last year, as the price would have included Spanish VAT. If you paid this year and Carmina haven’t paid U.K. VAT as part of the price then you need to pay that invoice.

If Carmina charged Spanish VAT and you paid this year then they have cocked up and need to give you that part back as you shouldn’t pay VAT twice.