TheNeedMachine

Distinguished Member

- Joined

- May 31, 2012

- Messages

- 5,339

- Reaction score

- 7,926

Without a doubt its legit

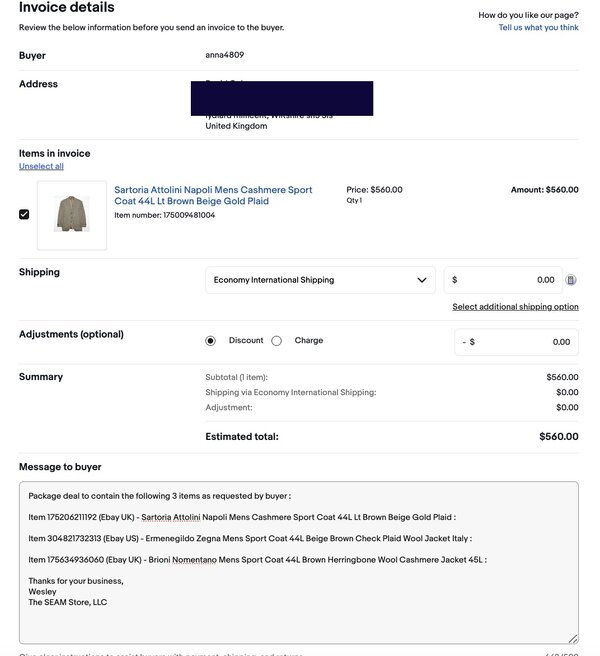

I would agree - I sold a RLBL Anthony recently and the labels appear to match (they're slightly different for style/fabric due to solid vs. stripes):

Last edited: