Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Talking stocks, trading, and investing in general

- Thread starter mikeman

- Start date

- Watchers 332

PhilKenSebben

Distinguished Member

- Joined

- Sep 16, 2012

- Messages

- 8,687

- Reaction score

- 9,835

I thought you already did that? Are you chasing a bit?Sooo, back to stocks. Thinking of moving some money into SPY Monday or Tuesday.

HRoi

Stylish Dinosaur

- Joined

- Dec 28, 2008

- Messages

- 25,315

- Reaction score

- 16,234

I was thinking to myself that the catch in all this was that they sell your info to fraudsters, but this is pretty good tooWTF is this? In order to participate in the Iowa Electronic Market, I have to mail them a god damn check?

Now I understand why these markets are so inefficient.

venividivicibj

Stylish Dinosaur

- Joined

- Apr 9, 2013

- Messages

- 22,869

- Reaction score

- 18,389

dat Peter North nutJust one nut?

otc

Stylish Dinosaur

- Joined

- Aug 15, 2008

- Messages

- 24,536

- Reaction score

- 19,193

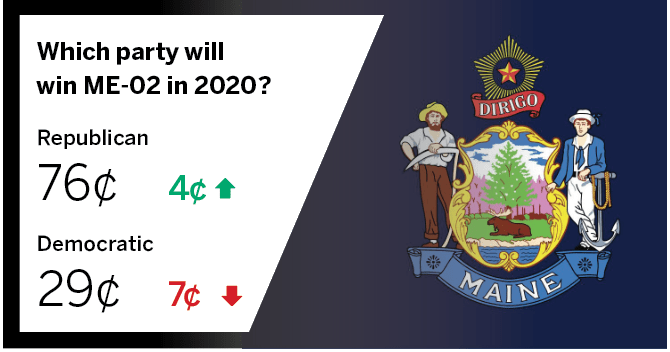

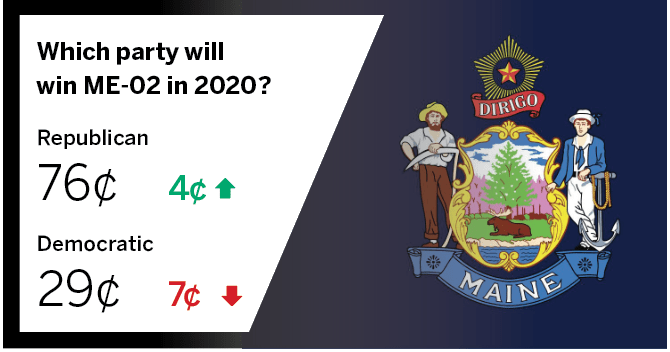

Ok, I found a zero-risk trading strategy that I could implement.

The spreads on the "Electoral College Margin" market are out of whack in a way that allows for a Negative Risk trade.

Basically you buy all of the "No" contracts and you get paid money. There are 16 total options and only one can be yes...so if you buy all 16, you get paid out $15. How much does it cost to buy all 16? only $14.83.

They net out the risk of your trades, so once you have placed all 16 trades, they refund you back to your maximum loss...which in this case means they refund you back more than you paid.

I deposited $10 in my account and after a few iterations I have made $1.93 profit from this trade.

(ignore the loss arrow, that's a paper loss that means nothing as the profit is already locked in).

I need to deposit more money. The problem here is that I only have enough money to buy 10 contracts at a time (since they are all 90+ cents each). Once you have bought the contracts, you are back above $10 and can start over...but it takes way too long to buy 10 at a time. These markets are thick, so you could buy thousands of contracts without moving the price if you had that much on deposit.

This guy made $400k trading on PredictIT...

luckboxmagazine.com

luckboxmagazine.com

The spreads on the "Electoral College Margin" market are out of whack in a way that allows for a Negative Risk trade.

Basically you buy all of the "No" contracts and you get paid money. There are 16 total options and only one can be yes...so if you buy all 16, you get paid out $15. How much does it cost to buy all 16? only $14.83.

They net out the risk of your trades, so once you have placed all 16 trades, they refund you back to your maximum loss...which in this case means they refund you back more than you paid.

I deposited $10 in my account and after a few iterations I have made $1.93 profit from this trade.

(ignore the loss arrow, that's a paper loss that means nothing as the profit is already locked in).

I need to deposit more money. The problem here is that I only have enough money to buy 10 contracts at a time (since they are all 90+ cents each). Once you have bought the contracts, you are back above $10 and can start over...but it takes way too long to buy 10 at a time. These markets are thick, so you could buy thousands of contracts without moving the price if you had that much on deposit.

This guy made $400k trading on PredictIT...

How I Turned $400 into $400,000 Trading Political Futures - luckbox magazine

I’ve always been a bit of a gambler. I went to college during the poker boom of the early 2000s, when everyone wanted to become the next Chris Moneymaker. I thought my experience playing cards with my grandfather and drafting fantasy football teams meant I had an advantage. It didn’t. Later...

Last edited:

otc

Stylish Dinosaur

- Joined

- Aug 15, 2008

- Messages

- 24,536

- Reaction score

- 19,193

#YOLO

I upped my deposit to $100 total and I've already made $27

Too bad they prohibit automated trading. Easy enough to scan for these opportunities and trade on them while they are above a certain profit %, but doing it by hand is slow. This one has enough payoff that it might be worth $50 or $100+/hr, but it is a pretty mind numbing hour of clicking "Buy".

That's probably part of why these opportunities exist though...if they allowed bots, the arbitrage would all be eaten up instantly.

edit: nevermind. you are limited to your max exposure of $850 in a single contract even though all contracts together cancel out.

So basically I made $48 but I can't buy any more. I'd have to find another opportunity.

If anyone else wants to make $48 with half an hour of work, just PM me and I'll explain how...meanwhile I will keep an eye out for other arbitrage opportunities.

I upped my deposit to $100 total and I've already made $27

Too bad they prohibit automated trading. Easy enough to scan for these opportunities and trade on them while they are above a certain profit %, but doing it by hand is slow. This one has enough payoff that it might be worth $50 or $100+/hr, but it is a pretty mind numbing hour of clicking "Buy".

That's probably part of why these opportunities exist though...if they allowed bots, the arbitrage would all be eaten up instantly.

edit: nevermind. you are limited to your max exposure of $850 in a single contract even though all contracts together cancel out.

So basically I made $48 but I can't buy any more. I'd have to find another opportunity.

If anyone else wants to make $48 with half an hour of work, just PM me and I'll explain how...meanwhile I will keep an eye out for other arbitrage opportunities.

Last edited:

venividivicibj

Stylish Dinosaur

- Joined

- Apr 9, 2013

- Messages

- 22,869

- Reaction score

- 18,389

What are deposit/withdrawal fees?

otc

Stylish Dinosaur

- Joined

- Aug 15, 2008

- Messages

- 24,536

- Reaction score

- 19,193

What are deposit/withdrawal fees?

No deposit fees, 5% withdrawal fee (which only gets charged a single time, so you can amortize that fee over any number of bets depending on how long you stay in).

Only transaction fee is 10% of your profits when you close out a position....but that should already be factored in to determining whether a trade is profitable.

I found a second one that had an opportunity, but I was only able to trade a couple hundred contracts before it went back to even money.

This website calculates negative risk for you--but it only updates every 5 minutes. Technically anything >~1.11 should be profitable after fees, but the ones that are listed at 1.11 aren't worth your time because the returns are miniscule. Better to wait and hope the spread opens up.

- Joined

- Apr 26, 2008

- Messages

- 28,618

- Reaction score

- 37,632

This is getting too complicated. What happened to the old way of investing where you just buy a strip club and launder money? That was so much easier and fun.

No deposit fees, 5% withdrawal fee (which only gets charged a single time, so you can amortize that fee over any number of bets depending on how long you stay in).

Only transaction fee is 10% of your profits when you close out a position....but that should already be factored in to determining whether a trade is profitable.

I found a second one that had an opportunity, but I was only able to trade a couple hundred contracts before it went back to even money.

This website calculates negative risk for you--but it only updates every 5 minutes. Technically anything >~1.11 should be profitable after fees, but the ones that are listed at 1.11 aren't worth your time because the returns are miniscule. Better to wait and hope the spread opens up.

PhilKenSebben

Distinguished Member

- Joined

- Sep 16, 2012

- Messages

- 8,687

- Reaction score

- 9,835

Nut deep is the way to beI put a small traunch in the other day but just a taste. I'm talking about putting the nut back into play.

venividivicibj

Stylish Dinosaur

- Joined

- Apr 9, 2013

- Messages

- 22,869

- Reaction score

- 18,389

cut employee benefits, keep dividend and CEO made $23m last year (you really gotta pay up for this kind of performance!)

PhilKenSebben

Distinguished Member

- Joined

- Sep 16, 2012

- Messages

- 8,687

- Reaction score

- 9,835

cut employee benefits, keep dividend and CEO made $23m last year (you really gotta pay up for this kind of performance!)

Put this *********** late stage capitalism thread. Absurd

- Joined

- Nov 21, 2008

- Messages

- 28,523

- Reaction score

- 30,343

cut employee benefits, keep dividend and CEO made $23m last year (you really gotta pay up for this kind of performance!)

Some companies are in for a rude awakening about talent.

FEATURED PRODUCTS

-

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket

A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket

A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

-

Wellington Chore Boot - Special Introductory Price! $495

Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

Wellington Chore Boot - Special Introductory Price! $495

Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

-

Besnard - Made to Order Trousers - $351 Design your ideal pair of trousers by selecting a fabric, deciding between single or double pleats, choosing a zip or button fly, and opting for side adjusters or belt loops.

Latest posts

- Replies

- 39,847

- Views

- 5,878,117

- Replies

- 0

- Views

- 1

- Replies

- 15,239

- Views

- 3,492,506

- Replies

- 12,234

- Views

- 3,440,211

Similar threads

- Replies

- 77

- Views

- 131,369

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett