- Joined

- May 30, 2013

- Messages

- 16,951

- Reaction score

- 38,848

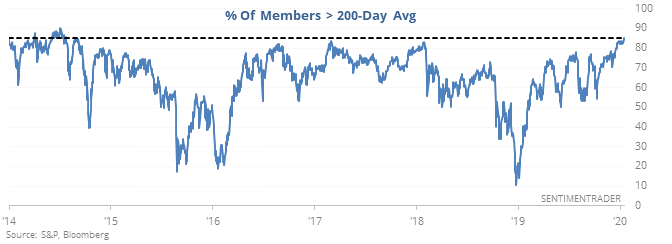

This is trending in a certain direction.

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

I’m sure I was, but I was an amusement park janitor and the pay rates were standardized by job function/tenure.You're not that old, I was just really good at my job. Or maybe you were just terrible at yours?

That's awful. I feel like with a little know how one can successfully manage to create their own annuity.My FIL wanted to talk investments the other night and it was after a few glasses of wine. The one thing that stood out was the sheer amount of fees they have paid and are continuing to pay for the annuities they were scared into buying during 08/09. I feel like $3M in assets were put into annuities and the fee is somewhere are 4.0%-4.5% annually. So for 11-12 years, they have paid over $1M total in fees. They have tried to make excuses for owning them but damn fees are a *****.

You can usually tell how awful a financial product is by how heavily incentivized advisers are to push them. The ****** who foisted those dogs on your ILs would have pocketed $200K+ on the deal.

LuxeSwap Auction - orSlow Japan Brown Gold Camp Shirt This mint condition offering from No Man Walks Alone favorite orSlow is a gem of a summer piece. The campy contrasts of 1970s colors of mustard and browns, all mixed together in a coherent presentation in a shatter mosaic print, makes this a go-to for an elevated spring get together. Offered at auction by LuxeSwap at $9.99 with no reserve.

LuxeSwap Auction - orSlow Japan Brown Gold Camp Shirt This mint condition offering from No Man Walks Alone favorite orSlow is a gem of a summer piece. The campy contrasts of 1970s colors of mustard and browns, all mixed together in a coherent presentation in a shatter mosaic print, makes this a go-to for an elevated spring get together. Offered at auction by LuxeSwap at $9.99 with no reserve.