Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Talking stocks, trading, and investing in general

- Thread starter mikeman

- Start date

- Watchers 332

amerikajinda

Distinguished Member

- Joined

- Apr 18, 2006

- Messages

- 9,929

- Reaction score

- 223

Thanks! Haven't traded on margin or messed with puts/calls/options/futures or anything like that yet, but I'm intrigued by your experiences and the whole adrenaline rush.

GreenFrog

Stylish Dinosaur

- Joined

- Oct 20, 2008

- Messages

- 13,767

- Reaction score

- 2,935

Honestly, I wouldn't recommend what I do unless you're risk-seeking and have big balls, really. At the end of the day, all I'm really doing is gambling with the house's money. Very, very risky behavior. I'm young and can afford this risk much more than someone in their late 20s / 30s / 40s, so you'll find that some of the more seasoned investors here take more conservative approaches, rightfully so.

Sometimes I stand back and evaluate what I'm doing and question how foolish my investing behavior really is, but I'm lusting after gains.. and big risk = big gains.

Anyway, I only day trade on margin when I have a couple hours on hand to monitor a stock. The stocks I pick to day trade aren't based on fundamentals at all. I simply screen which stocks have popped during the day and look for decent volume (liquidity), and high volatility. Then I monitor the stock's movements for the first couple of hours into the trading session. Then I trade on the stock's movement patterns. Some stocks that pop follow a really predictable up / down pattern and those are the ones I pick.

This past friday, for example. Bought into a position with ICLD, which popped 200%+. Extremely volatile swings and at one point, I was down almost 7% and panicking like crazy. Put in a limit order for a share price a couple percentage points above my cost basis and it hit that target within 10 minutes. Was satisfied with that until the stock literally popped again another 50% around 10 minutes after I sold. Could have made a cool five figures off of that 50% pop... but alas, that 7% drop earlier made me panic and want to get out ASAP. But... if I only I had waited a bit longer. Anyway, it could have very well dropped another 50% and that would have triggered a nasty margin call. It's a constant mind game of 'what if...' and that can be very stressful.

You can sense my frustration, even though I made decent coin on the trade anyway.

I hate how my mind works, sometimes.

Sometimes I stand back and evaluate what I'm doing and question how foolish my investing behavior really is, but I'm lusting after gains.. and big risk = big gains.

Anyway, I only day trade on margin when I have a couple hours on hand to monitor a stock. The stocks I pick to day trade aren't based on fundamentals at all. I simply screen which stocks have popped during the day and look for decent volume (liquidity), and high volatility. Then I monitor the stock's movements for the first couple of hours into the trading session. Then I trade on the stock's movement patterns. Some stocks that pop follow a really predictable up / down pattern and those are the ones I pick.

This past friday, for example. Bought into a position with ICLD, which popped 200%+. Extremely volatile swings and at one point, I was down almost 7% and panicking like crazy. Put in a limit order for a share price a couple percentage points above my cost basis and it hit that target within 10 minutes. Was satisfied with that until the stock literally popped again another 50% around 10 minutes after I sold. Could have made a cool five figures off of that 50% pop... but alas, that 7% drop earlier made me panic and want to get out ASAP. But... if I only I had waited a bit longer. Anyway, it could have very well dropped another 50% and that would have triggered a nasty margin call. It's a constant mind game of 'what if...' and that can be very stressful.

You can sense my frustration, even though I made decent coin on the trade anyway.

I hate how my mind works, sometimes.

Last edited:

polloloco

Member

- Joined

- Oct 6, 2010

- Messages

- 14

- Reaction score

- 0

Stevent, all aboard the MJ train. Check out GWPH. Sativex for MS has already been approved in over 20 countries, and in the process of receiving US approval. GW is also partnering with Novartis for distribution in Oceania, and other parts. With their patents and continued research (clinical trials into treating types of brain tumors), they have some good potential to generate decent returns in near future.

amerikajinda

Distinguished Member

- Joined

- Apr 18, 2006

- Messages

- 9,929

- Reaction score

- 223

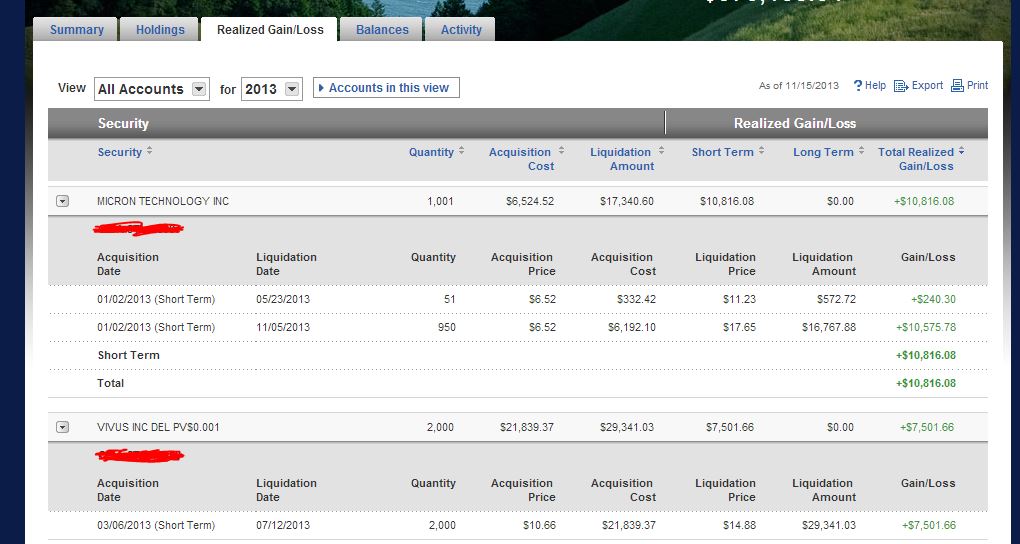

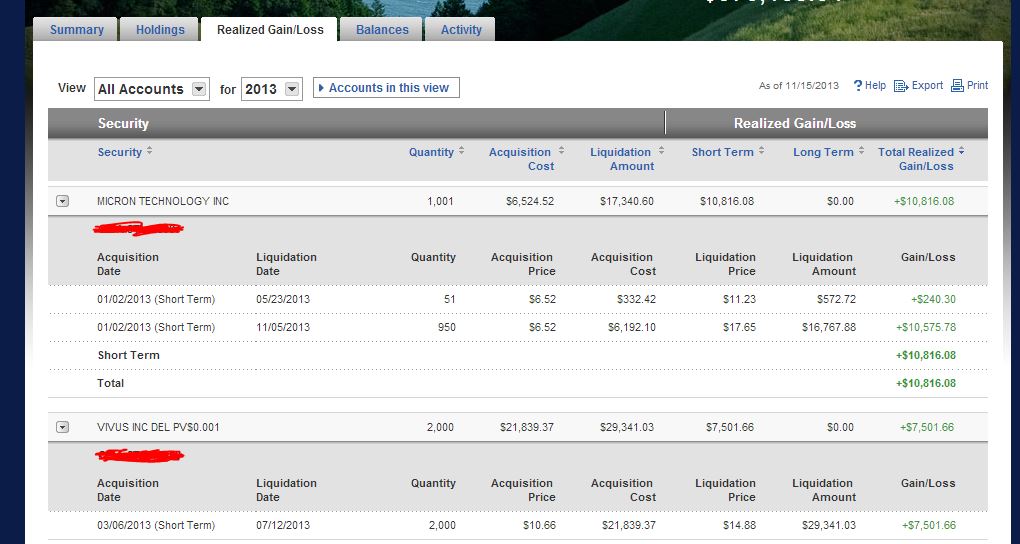

I'm just now reading through this thread for the first time. Some good advice (in hindsight) here! Both these guys recommended Micron Technology (MU) a while back. I didn't see their posts at the time, but turns out to have been very prescient advice!

An article online today at Seeking Alpha also says there's still time to jump on the MU bandwagon:

http://seekingalpha.com/article/184...ing-to-rally-again-time-to-join-the-bandwagon

I picked up a little over a thousand shares at the beginning of the year at $6.52, sold some in May at $11.23, but let the rest ride all the way up to $17.65 when I locked in some gains a few weeks ago. Did I lock in too early? Today it's up over $19... :foo:

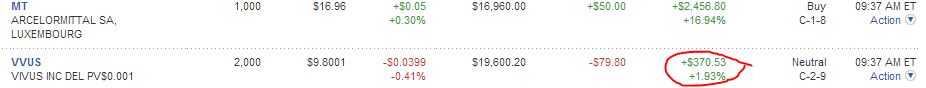

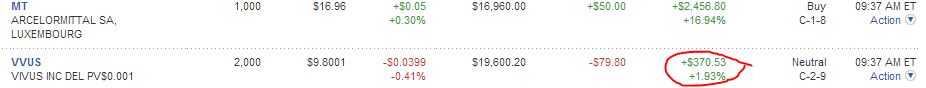

Another winner I locked in is VIVUS, Inc. (VVUS). [Disclaimer -- I own VVUS] Bought a couple thousand shares in March of this year at $10.66, rode it up to $14.88 where I locked in in July. It went all the way down to $9.37 earlier this month, so I decided to jump aboard again for the ride. Repurchased all my shares, and am currently up less than 2% but I think it can hit $14 again, at which point I'll (hopefully!) lock in more gains.

Also like MT which is up almost 17%.

[Disclaimer - I own MT] fwiw.

[Disclosure: I own MU] I've enjoyed Micron (MU) and they have been gaining steadily. They make SSDs that I forsee being integral in new laptops and ipods.

I'm a light investor, pretty conservative and dont take crazy risks. I'll admit i dont know much about options but i do know a good deal. I want to share a tip of a company on the rise. Micron Technology, ticker MU, they make semiconductors, and have shown steady growth analysts said the stock is valued at $17 and is tarding at $11.26 currently. Glad someone put a thread like this up... Lets hope for a Bull market everyone!

I'm just now reading through this thread for the first time. Some good advice (in hindsight) here! Both these guys recommended Micron Technology (MU) a while back. I didn't see their posts at the time, but turns out to have been very prescient advice!

An article online today at Seeking Alpha also says there's still time to jump on the MU bandwagon:

http://seekingalpha.com/article/184...ing-to-rally-again-time-to-join-the-bandwagon

I picked up a little over a thousand shares at the beginning of the year at $6.52, sold some in May at $11.23, but let the rest ride all the way up to $17.65 when I locked in some gains a few weeks ago. Did I lock in too early? Today it's up over $19... :foo:

Another winner I locked in is VIVUS, Inc. (VVUS). [Disclaimer -- I own VVUS] Bought a couple thousand shares in March of this year at $10.66, rode it up to $14.88 where I locked in in July. It went all the way down to $9.37 earlier this month, so I decided to jump aboard again for the ride. Repurchased all my shares, and am currently up less than 2% but I think it can hit $14 again, at which point I'll (hopefully!) lock in more gains.

Also like MT which is up almost 17%.

[Disclaimer - I own MT] fwiw.

Last edited:

amerikajinda

Distinguished Member

- Joined

- Apr 18, 2006

- Messages

- 9,929

- Reaction score

- 223

Well you're having fun! Just be careful.... but it sounds like you know what you're doing!

Just be careful.... but it sounds like you know what you're doing!

Honestly, I wouldn't recommend what I do unless you're risk-seeking and have big balls, really. At the end of the day, all I'm really doing is gambling with the house's money. Very, very risky behavior. I'm young and can afford this risk much more than someone in their late 20s / 30s / 40s, so you'll find that some of the more seasoned investors here take more conservative approaches, rightfully so.

Sometimes I stand back and evaluate what I'm doing and question how foolish my investing behavior really is, but I'm lusting after gains.. and big risk = big gains.

Anyway, I only day trade on margin when I have a couple hours on hand to monitor a stock. The stocks I pick to day trade aren't based on fundamentals at all. I simply screen which stocks have popped during the day and look for decent volume (liquidity), and high volatility. Then I monitor the stock's movements for the first couple of hours into the trading session. Then I trade on the stock's movement patterns. Some stocks that pop follow a really predictable up / down pattern and those are the ones I pick.

This past friday, for example. Bought into a position with ICLD, which popped 200%+. Extremely volatile swings and at one point, I was down almost 7% and panicking like crazy. Put in a limit order for a share price a couple percentage points above my cost basis and it hit that target within 10 minutes. Was satisfied with that until the stock literally popped again another 50% around 10 minutes after I sold. Could have made a cool five figures off of that 50% pop... but alas, that 7% drop earlier made me panic and want to get out ASAP. But... if I only I had waited a bit longer. Anyway, it could have very well dropped another 50% and that would have triggered a nasty margin call. It's a constant mind game of 'what if...' and that can be very stressful.

You can sense my frustration, even though I made decent coin on the trade anyway.

I hate how my mind works, sometimes.

Well you're having fun!

Just be careful.... but it sounds like you know what you're doing!

Just be careful.... but it sounds like you know what you're doing!

Last edited:

stevent

Distinguished Member

- Joined

- Feb 16, 2010

- Messages

- 9,564

- Reaction score

- 1,483

Haha nice, just sold Tesla today and now I'll have minimized taxes though I do have some IPO shares with cost basis of pretty much 0% I sold earlier so no way I can avoid there

Just another fool with his money.

Stevent, I exited my TAN position. Made 6.95 profit on that trade lol. Gonna buy on a dip.

Haha nice, just sold Tesla today and now I'll have minimized taxes though I do have some IPO shares with cost basis of pretty much 0% I sold earlier so no way I can avoid there

idfnl

Stylish Dinosaur

- Joined

- Dec 6, 2008

- Messages

- 17,305

- Reaction score

- 1,260

Don't **** with margin.

Thanks! Haven't traded on margin or messed with puts/calls/options/futures or anything like that yet, but I'm intrigued by your experiences and the whole adrenaline rush.

Don't **** with margin.

amerikajinda

Distinguished Member

- Joined

- Apr 18, 2006

- Messages

- 9,929

- Reaction score

- 223

Wise advice! Think I'll stick to the basics idfnl! Although it is tempting... still, think I'll stay on the sidelines until I know what I'm doing.

Don't **** with margin.

Wise advice! Think I'll stick to the basics idfnl! Although it is tempting... still, think I'll stay on the sidelines until I know what I'm doing.

Last edited:

amerikajinda

Distinguished Member

- Joined

- Apr 18, 2006

- Messages

- 9,929

- Reaction score

- 223

Oh yeah -- you always have to harvest your tax losses this time of year!

Some people fear taxes on stock gains but it does mean you are gaining money. Now there are the offsets of selling a stinker that lost you a ton but winners paying taxes is nothing to be scared of.

Oh yeah -- you always have to harvest your tax losses this time of year!

stevent

Distinguished Member

- Joined

- Feb 16, 2010

- Messages

- 9,564

- Reaction score

- 1,483

Some margin is fine, I've made a lot of extra money through margin during college

Paying taxes means buying less shooz and potentially having to sell shooz as all my money goes right back into market. Doesn't hurt to take some losses to offset gains.

Wise advice! Think I'll stick to the basics idfnl! Although it is tempting... still, think I'll stay on the sidelines until I know what I'm doing.

Don't **** with margin.

Some margin is fine, I've made a lot of extra money through margin during college

Some people fear taxes on stock gains but it does mean you are gaining money. Now there are the offsets of selling a stinker that lost you a ton but winners paying taxes is nothing to be scared of.

Paying taxes means buying less shooz and potentially having to sell shooz as all my money goes right back into market. Doesn't hurt to take some losses to offset gains.

jbarwick

Distinguished Member

- Joined

- Nov 28, 2012

- Messages

- 8,732

- Reaction score

- 9,707

The only time taxes should really be worried about are when your money is making more for you than your day job. Hell and most people in this thread seem to be day trading and not holding long term so they are paying STCG anyway.

sinnedk

Stylish Dinosaur

- Joined

- Nov 15, 2010

- Messages

- 17,108

- Reaction score

- 5,116

well wish i held micron

what do you guys think of zynga? looks like its recovering

I'm just now reading through this thread for the first time. Some good advice (in hindsight) here! Both these guys recommended Micron Technology (MU) a while back. I didn't see their posts at the time, but turns out to have been very prescient advice!

An article online today at Seeking Alpha also says there's still time to jump on the MU bandwagon:

http://seekingalpha.com/article/184...ing-to-rally-again-time-to-join-the-bandwagon

I picked up a little over a thousand shares at the beginning of the year at $6.52, sold some in May at $11.23, but let the rest ride all the way up to $17.65 when I locked in some gains a few weeks ago. Did I lock in too early? Today it's up over $19... :foo:

Another winner I locked in is VIVUS, Inc. (VVUS). [Disclaimer -- I own VVUS] Bought a couple thousand shares in March of this year at $10.66, rode it up to $14.88 where I locked in in July. It went all the way down to $9.37 earlier this month, so I decided to jump aboard again for the ride. Repurchased all my shares, and am currently up less than 2% but I think it can hit $14 again, at which point I'll (hopefully!) lock in more gains.

Also like MT which is up almost 17%.

[Disclaimer - I own MT] fwiw.

well wish i held micron

what do you guys think of zynga? looks like its recovering

FEATURED PRODUCTS

-

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve. -

Wellington Chore Boot - Special Introductory Price! $495 Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

Wellington Chore Boot - Special Introductory Price! $495 Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way. -

Besnard - Made to Order Trousers - $351 Design your ideal pair of trousers by selecting a fabric, deciding between single or double pleats, choosing a zip or button fly, and opting for side adjusters or belt loops.

Latest posts

- Replies

- 18,498

- Views

- 3,687,714

- Replies

- 3,862

- Views

- 971,255

- Replies

- 52,109

- Views

- 6,594,785

- Replies

- 36,609

- Views

- 4,455,117

Similar threads

- Replies

- 77

- Views

- 131,395

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Members online

- Thin White Duke

- Hombre Secreto

- Michigan Planner

- sjmin209

- APK

- classicoutfits

- tim_horton

- Old Red

- evangel21

- othertravel

- Lendo

- ahjota

- nootje

- shirtingfantasy

- suitforcourt

- JayDotz

- ktaisa

- polojock615

- kakishiboo

- nqtri

- edinatlanta

- ChorizoHowitzer

- MJMcRibb

- RapFan

- lindenbaum

- Nano_kyle

- wdahab

- ericgereghty

- vespertiliovir

- marklin

- modernize

- trancebepopulate

- elbowtron

- sononchalant

- StanleyWingtip

- Sandman3769

- d90000

- ymc226

- SilentPartner

- Alternate

- sushijerk

- GG Allin

- whyme?

- Gargat

- sensuki

- kid1002

- mossrockss

Total: 2,303 (members: 68, guests: 2,235)