othertravel

Distinguished Member

- Joined

- Feb 9, 2011

- Messages

- 9,993

- Reaction score

- 3,894

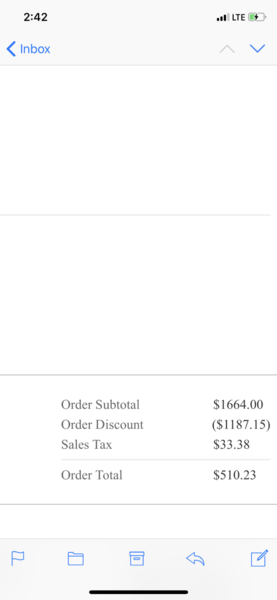

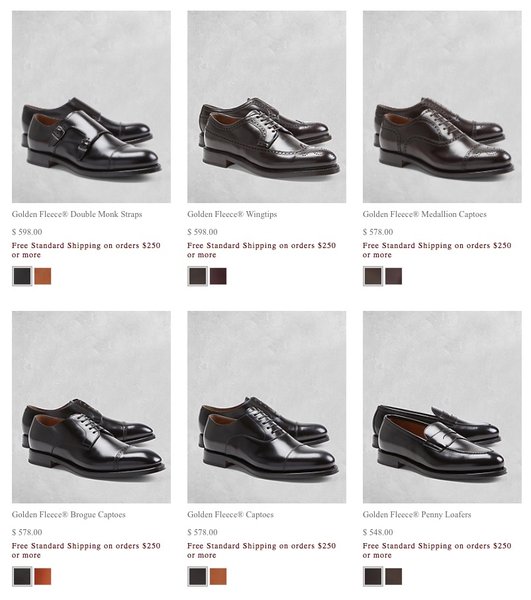

Why were these Double Monks taken off the site???

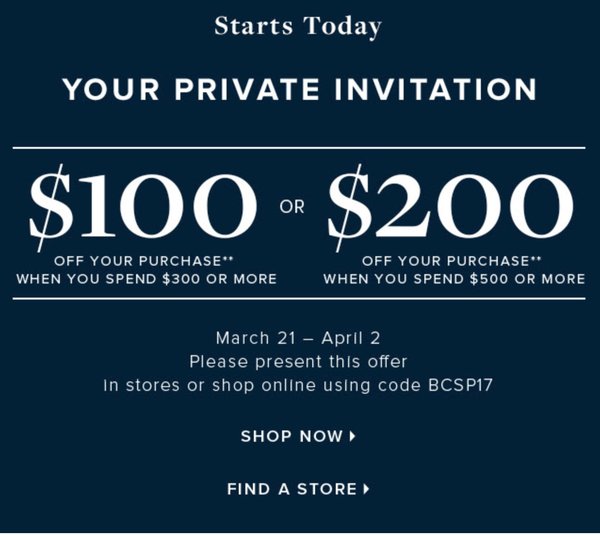

Since I'm buying these shoes I have been looking into them myself. Once I get a response (if online doesn't give before me) I will definitely let you know!

Why were these Double Monks taken off the site???