Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Ultimate Vass (Footwear) Thread (Pictures, reviews, sizing, etc...)

- Thread starter luk-cha

- Start date

- Watchers 835

Cheshire symposium

Senior Member

- Joined

- May 4, 2019

- Messages

- 199

- Reaction score

- 199

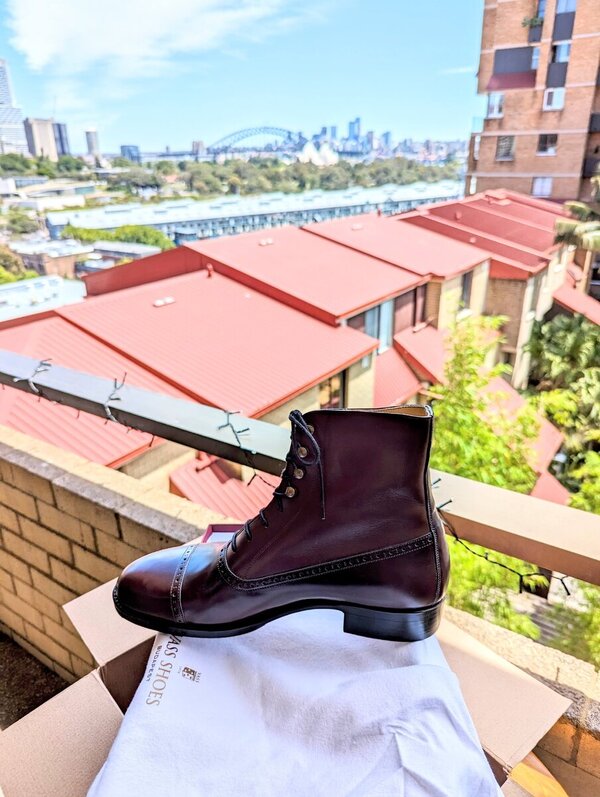

Like the shoes; but I don’t think that the top half and the bottom half of your outfit work well together.Cross- post from HOF. F last, museum plum. View attachment 1538481 View attachment 1538482

monkey66

Senior Member

- Joined

- Jul 14, 2020

- Messages

- 611

- Reaction score

- 2,357

Yeah, I have mixed feelings too about this one.Like the shoes; but I don’t think that the top half and the bottom half of your outfit work well together.

Schweino

Distinguished Member

- Joined

- Jan 29, 2008

- Messages

- 1,603

- Reaction score

- 2,903

Not that I needed more Vass (or shoes in general), but I won an Ebay auction for a Vass V-tip brogue, bordeaux museum calf, F last - at $300. I couldn't say no. Will post pics as soon as they arrive! Loving the start of this year, haha.

Your luck that the Brexit trade agreement is not in place yet you or I would have outbid you

If I buy from the UK now about 26% tax + fees will be added so I let this one go (as all other UK based items)

tbaja27

Senior Member

- Joined

- Feb 16, 2019

- Messages

- 187

- Reaction score

- 295

Your luck that the Brexit trade agreement is not in place yet you or I would have outbid you

If I buy from the UK now about 26% tax + fees will be added so I let this one go (as all other UK based items)

I'll take it! It wasn't a must-have for me so it would have been all yours.

Cheshire symposium

Senior Member

- Joined

- May 4, 2019

- Messages

- 199

- Reaction score

- 199

I can’t get my head around the new system. If I am in the UK and import shoes in from the EU; I presume I don’t pay EU VAT (say 19%), but would be charged UK VAT of 20% + custom charges (item specific so I don’t know shoes would be) + handling fees (again unknown amount). So it’s a bit extra, than we would normally pay, but how you get to 26%?Your luck that the Brexit trade agreement is not in place yet you or I would have outbid you

If I buy from the UK now about 26% tax + fees will be added so I let this one go (as all other UK based items)

Schweino

Distinguished Member

- Joined

- Jan 29, 2008

- Messages

- 1,603

- Reaction score

- 2,903

I can’t get my head around the new system. If I am in the UK and import shoes in from the EU; I presume I don’t pay EU VAT (say 19%), but would be charged UK VAT of 20% + custom charges (item specific so I don’t know shoes would be) + handling fees (again unknown amount). So it’s a bit extra, than we would normally pay, but how you get to 26%?

21% VAT, 5% import charges for shoes = 26%

This is calculated on the item price + postage!

Since ebay sales are private sales VAT deduction doesn't apply unfortunately.

Added to that handling charges by the postal carrier equals assrape imo

Cheshire symposium

Senior Member

- Joined

- May 4, 2019

- Messages

- 199

- Reaction score

- 199

Where does the 21% VAT come from? UK VAT is 20%.21% VAT, 5% import charges for shoes = 26%

This is calculated on the item price + postage!

Since ebay sales are private sales VAT deduction doesn't apply unfortunately.

Added to that handling charges by the postal carrier equals assrape imo

I thought that we don't pay VAT in the EU, so saving 19% for Germany fro example.

Wouldn't the net increase be 5% - just covering the import charges?

Schweino

Distinguished Member

- Joined

- Jan 29, 2008

- Messages

- 1,603

- Reaction score

- 2,903

Where does the 21% VAT come from? UK VAT is 20%.

I thought that we don't pay VAT in the EU, so saving 19% for Germany fro example.

Wouldn't the net increase be 5% - just covering the import charges?

I live in the Netherlands where VAT is 21%. So when buying shoes from outside of the EU, I have to pay 21% + 5% + handling charges. Trust me, got stung multiple times

When buying from a company, VAT from the seller will be deducted, but whe buying from a private seller this wont happen. So, if I bought the Vass shoes from Ebay for 200 UKP + 20 UKP postage for instance, I will get charged 220 UKP = approx. 250 EUR. 26% of 250 EUR is 65 eur. Add approximately 15 eur handling fees which leaves me paying 80 euros extra on top of the 200 UKP the shoes would have cost me before Brexit

So, basically Brexit makes Ebay.co.uk sales significantly more expensive for EU residents

Notch

Distinguished Member

- Joined

- Jul 27, 2010

- Messages

- 2,966

- Reaction score

- 7,229

I was talking with a sales agent from AA Crack & Sons, and they told me this: 'As we have signed a free trade agreement with the EU, there are no Tariff Duties due'. So while you will need to pay VAT, I'm not sure about the 5% import charges. If 2 countries or groups of countries sign a free trade agreement, there shouldn't be any import charges.

Schweino

Distinguished Member

- Joined

- Jan 29, 2008

- Messages

- 1,603

- Reaction score

- 2,903

I was talking with a sales agent from AA Crack & Sons, and they told me this: 'As we have signed a free trade agreement with the EU, there are no Tariff Duties due'. So while you will need to pay VAT, I'm not sure about the 5% import charges. If 2 countries or groups of countries sign a free trade agreement, there shouldn't be any import charges.

True, but the agreement is not in place yet.

From the Dutch government site:

Ordering goods via UK web shops will be the same as ordering goods from outside the EU, such as the US or China. In that case, you will need to pay Dutch VAT (BTW) on products that cost €22 or more. You will also need to pay import duties if products cost more than €150.

Zapasman

Distinguished Member

- Joined

- Oct 2, 2014

- Messages

- 3,726

- Reaction score

- 2,935

Theory is one thing, practice is another. Go and hassle with your courrier and explain them the law and the trade agreement to recover your money. You can also do the same with the etailer. At the moment, anything is possible. Believe me. I w8ll let the time pass by and see prices.I was talking with a sales agent from AA Crack & Sons, and they told me this: 'As we have signed a free trade agreement with the EU, there are no Tariff Duties due'. So while you will need to pay VAT, I'm not sure about the 5% import charges. If 2 countries or groups of countries sign a free trade agreement, there shouldn't be any import charges.

Classic Menswear Featured products

-

Carmina - Norwegian Derby Shoes Introducing the classy six eyelet split toe derby in a burgundy Shell Cordovan from Horween Chicago. This style features a single oak-bark tanned sole from Rendembach Jr. and full calf lining color brown.

-

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve. -

Kirby Allison - Luxury Suit Hanger - $32 Kirby Allison's Luxury Wooden Suit Hangers protect your suits from stretched collars and droopy shoulders. Our wooden suit hangers provide five-times more support than average hangers and will protect and extend the life of your most important garments.

Kirby Allison - Luxury Suit Hanger - $32 Kirby Allison's Luxury Wooden Suit Hangers protect your suits from stretched collars and droopy shoulders. Our wooden suit hangers provide five-times more support than average hangers and will protect and extend the life of your most important garments.

FEATURED PRODUCTS

-

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket

A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket

A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

-

Wellington Chore Boot - Special Introductory Price! $495

Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

Wellington Chore Boot - Special Introductory Price! $495

Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

-

Besnard - Made to Order Trousers - $351 Design your ideal pair of trousers by selecting a fabric, deciding between single or double pleats, choosing a zip or button fly, and opting for side adjusters or belt loops.

Latest posts

- Replies

- 12,221

- Views

- 3,436,931

- Replies

- 0

- Views

- 11

- Replies

- 27,451

- Views

- 4,312,585

- Replies

- 0

- Views

- 15

Similar threads

- Replies

- 298

- Views

- 31,170

- Replies

- 1

- Views

- 6,223

- Replies

- 294

- Views

- 101,815

- Replies

- 61

- Views

- 48,121

- Replies

- 17

- Views

- 14,491

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett