Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Talking stocks, trading, and investing in general

- Thread starter mikeman

- Start date

- Watchers 332

jbarwick

Distinguished Member

- Joined

- Nov 28, 2012

- Messages

- 8,728

- Reaction score

- 9,689

You know how I know i have become a grown adult with an unencumbered discretionary budget?

I just got home from Target and I have no idea how much money I spent. Really didn't even pay attention. Based on the amount of stuff in the bag I'd have to guess it is somewhere between 20 and 100...

Weird feeling.

Also, they literally had zero kinds of cereal on sale. Bullshit.

I've only started to feel this way in the past year. I mean I still show up to Kroger with a couple coupons but otherwise I have stopped worrying too much. As long as the monthly CC bill is in check, how that itemizes and worrying about it causes more harm than good.

- Joined

- May 30, 2013

- Messages

- 16,905

- Reaction score

- 38,684

Times are tough all over.

imatlas

Saucy White Boy

- Joined

- May 27, 2008

- Messages

- 24,798

- Reaction score

- 28,619

Lets talk life insurance. I'm starting to feel a hint over-insured: I have the usual term coverage through work, plus a rider that brings it up to enough to cover the remainder of our mortgage. We also have a joint protection whole life plan for $100K that we bought when we first got married. I worked for the insurance company at the time, and even then I knew that whole life is the most expensive way to buy insurance, but I got the employee discount off the first year's premiums.

I've got enough term insurance through work to cover our mortgage; we've got significant savings and my wife has a fairly well paying job with very good career prospects. Given that, the whole life plan is really just an additional cushion in case I get laid off or to give her an extra leg up if I die. If we still want or need that extra cushion, I would almost certainly be better off canceling the whole life plan and buying term, but i'm not sure we even need the extra insurance at all.

Any opinions? For those that have it, do you have a hefty amount of life insurance, just enough, or not enough to cover the minimum your family might need?

I've got enough term insurance through work to cover our mortgage; we've got significant savings and my wife has a fairly well paying job with very good career prospects. Given that, the whole life plan is really just an additional cushion in case I get laid off or to give her an extra leg up if I die. If we still want or need that extra cushion, I would almost certainly be better off canceling the whole life plan and buying term, but i'm not sure we even need the extra insurance at all.

Any opinions? For those that have it, do you have a hefty amount of life insurance, just enough, or not enough to cover the minimum your family might need?

jbarwick

Distinguished Member

- Joined

- Nov 28, 2012

- Messages

- 8,728

- Reaction score

- 9,689

We have term insurance on each of us to cover the mortgage then are paid enough to cover other expenses. Don't think we would ever pay for whole life and at some point term doesn't really make sense either.

I think you mentioned you were approaching 50 so from a retirement savings standpoint, you should be well on your to funding 2 retirements and if one of you kick the bucket early, it should be easy to fund a single persons retirement.

I think you mentioned you were approaching 50 so from a retirement savings standpoint, you should be well on your to funding 2 retirements and if one of you kick the bucket early, it should be easy to fund a single persons retirement.

Piobaire

Not left of center?

- Joined

- Dec 5, 2006

- Messages

- 81,836

- Reaction score

- 63,375

I mean I still show up to Kroger with a couple coupons but otherwise I have stopped worrying too much.

Mrs. Piob is always clipping coupons. We also watch for sales and buy in quantity for future needs. Like if pork is on sale really cheap I'll buy enough for a couple batches of sausage and just freeze until I'm ready to use. The beef shanks simmering into demi right now were bought as a "manager's special" and tossed in the freezer, I save wing tips from butchering my own wings (bought on sale of course,) and stuff like that. It's more a habit than a need I guess.

Life insurance...we bought 20 and 30 year term policies on a couple of occasions. Back when things were tight we bought 250k on each of us for 30 years (will expire in our early 60s.) Then as our incomes increased we just would buy a new policy when we felt it was needed. When we bought the Piob Palace seven years ago we took out enough to cover the mortgage...which is now moot. The last policy was 250k on me alone through my former place. It follows me even though I've left and will expire at my age 70.

So we basically layered on term as we felt needed and are not buying anymore at this point as the policies expire.

- Joined

- May 30, 2013

- Messages

- 16,905

- Reaction score

- 38,684

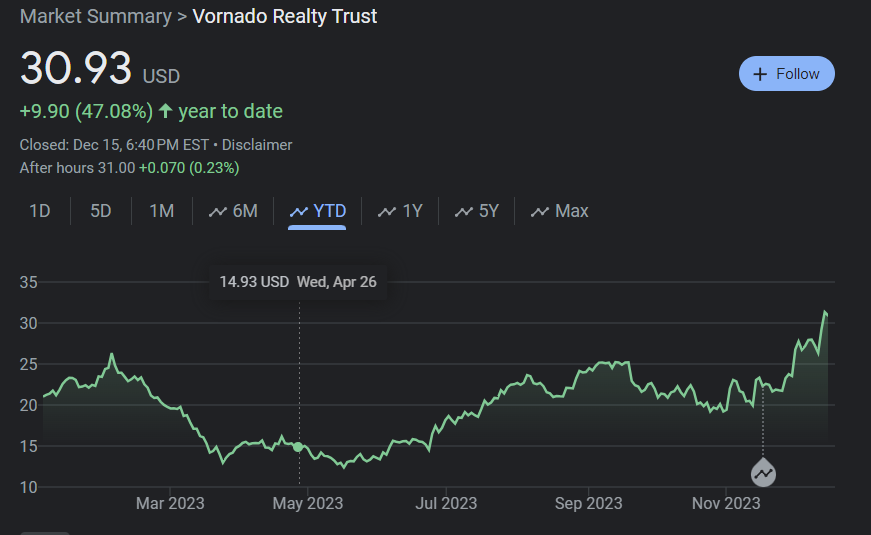

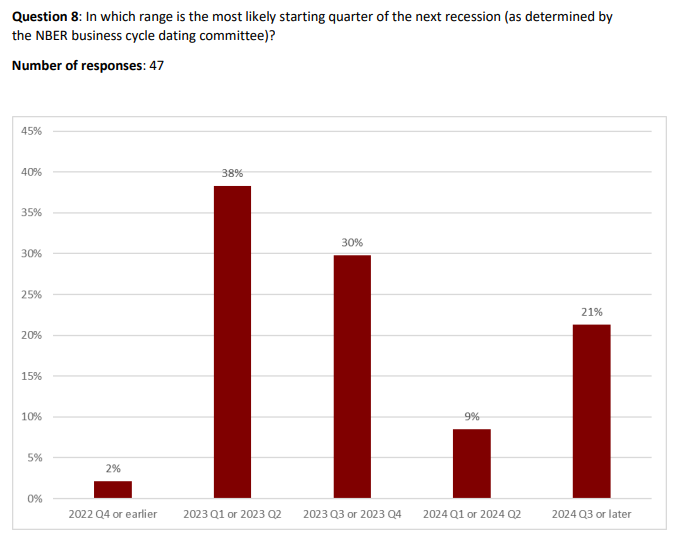

Calling the top.

- Joined

- Apr 26, 2008

- Messages

- 28,607

- Reaction score

- 37,611

He is a millionaire. He even says so in his name.

- Joined

- Jul 24, 2009

- Messages

- 34,008

- Reaction score

- 41,137

I can see him so he's a ****** chameleon.

- Joined

- Oct 16, 2006

- Messages

- 38,393

- Reaction score

- 13,643

Not really. Only his millions are invisible.I can see him so he's a ****** chameleon.

usctrojans31

Distinguished Member

- Joined

- Dec 12, 2009

- Messages

- 2,239

- Reaction score

- 1,366

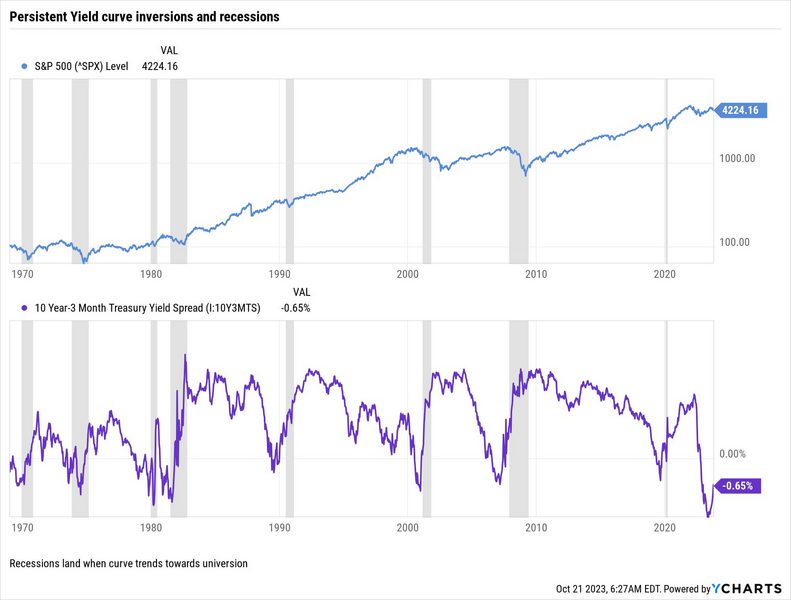

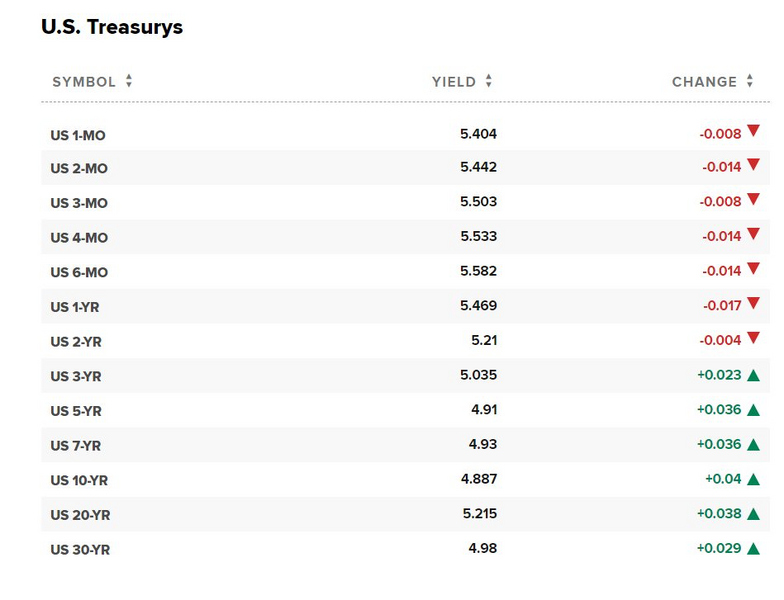

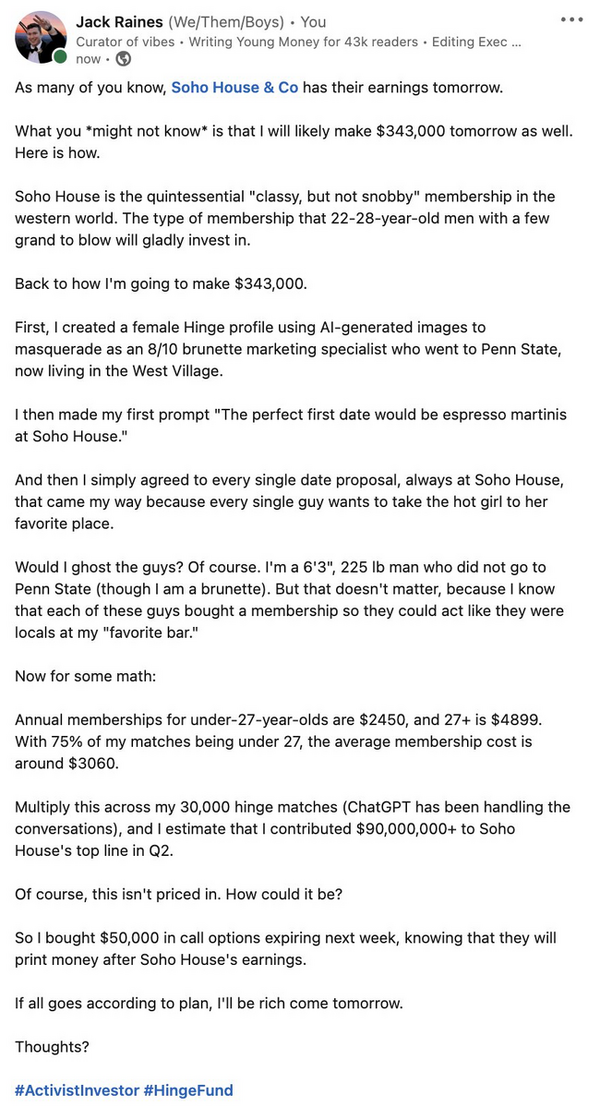

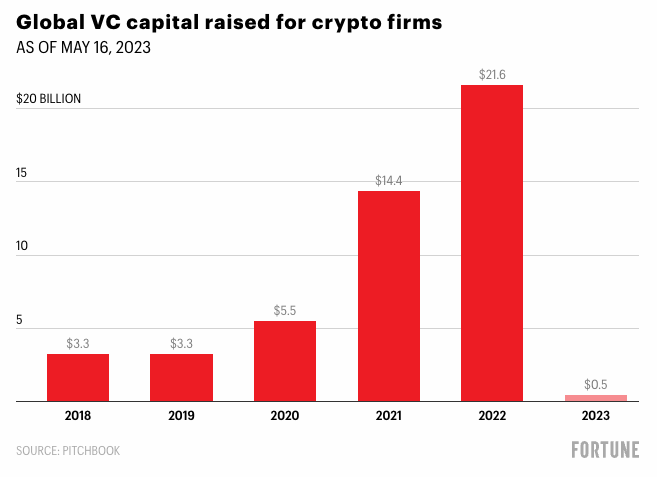

Covers a lot of what has already been discussed, but interesting nonetheless.

jbarwick

Distinguished Member

- Joined

- Nov 28, 2012

- Messages

- 8,728

- Reaction score

- 9,689

I forget how everyone here categorizes their HSA. Do you consider it a retirement asset since it can be invested or as another category? Trying to figure out how to look at the $7,100 we will contribute to our HSA next year. This year since I only contributed a couple thousand, I left it to the side but since we lose our Roth IRA ability next year, I am focusing on the HSA.

otc

Stylish Dinosaur

- Joined

- Aug 15, 2008

- Messages

- 24,531

- Reaction score

- 19,187

I have never drawn on my HSA, but I'm also not doing the insane "save your receipts for 30 years" thing to totally maximize the retirement benefit.

If I had major medical expenses, I wouldn't be against pulling money, but I haven't been using it for ordinary expenses.

If I had major medical expenses, I wouldn't be against pulling money, but I haven't been using it for ordinary expenses.

FEATURED PRODUCTS

-

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket

A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket

A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

-

Wellington Chore Boot - Special Introductory Price! $495

Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

Wellington Chore Boot - Special Introductory Price! $495

Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

-

Besnard - Made to Order Trousers - $351 Design your ideal pair of trousers by selecting a fabric, deciding between single or double pleats, choosing a zip or button fly, and opting for side adjusters or belt loops.

Latest posts

- Replies

- 0

- Views

- 11

- Replies

- 27,451

- Views

- 4,312,585

- Replies

- 0

- Views

- 15

- Replies

- 0

- Views

- 29

Similar threads

- Replies

- 77

- Views

- 131,336

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett