jbarwick

Distinguished Member

- Joined

- Nov 28, 2012

- Messages

- 8,719

- Reaction score

- 9,670

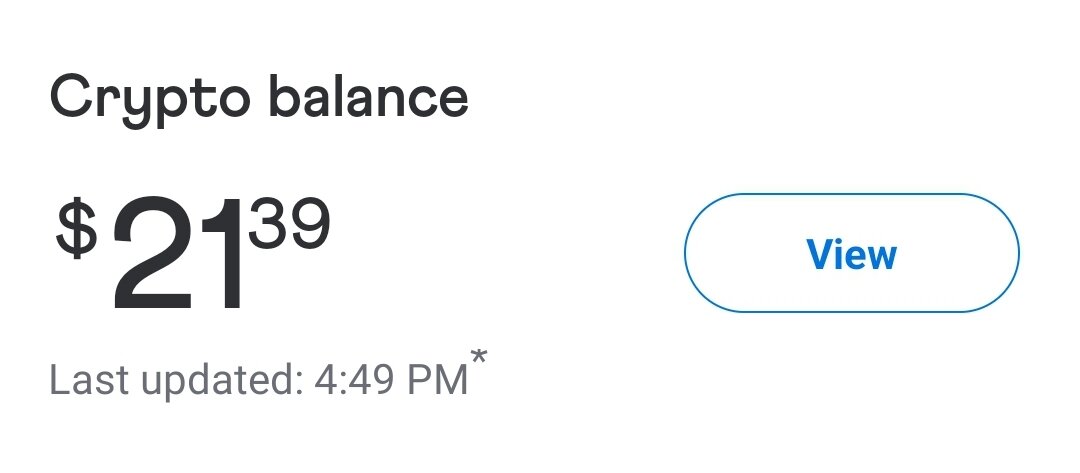

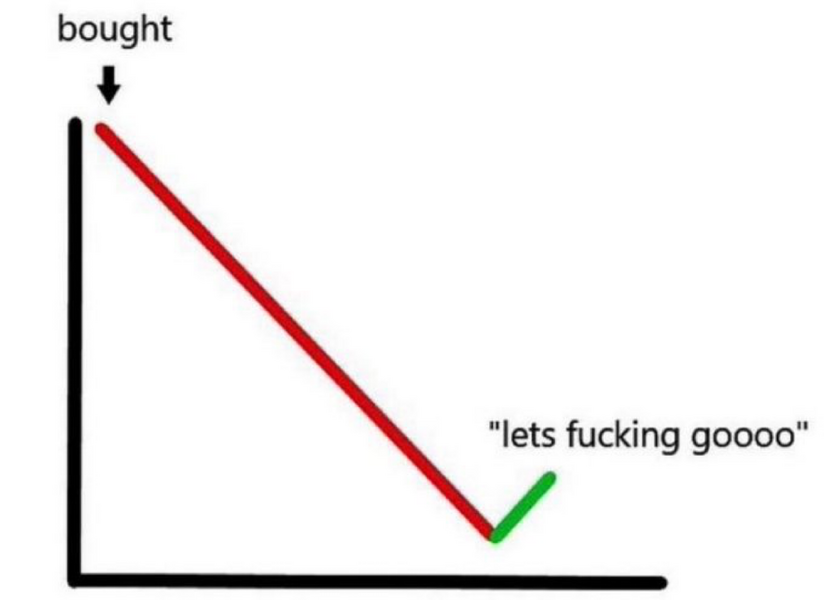

So you have an organized crime groups BTC which was worth over $400M when you confiscated it and now it is over $2B. Someone is either going to "hack" those BTC, government officials will end up dead, or some other crazy scheme where with a combination of theft and death.