Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Talking stocks, trading, and investing in general

- Thread starter mikeman

- Start date

- Watchers 331

Piobaire

Not left of center?

- Joined

- Dec 5, 2006

- Messages

- 81,812

- Reaction score

- 63,321

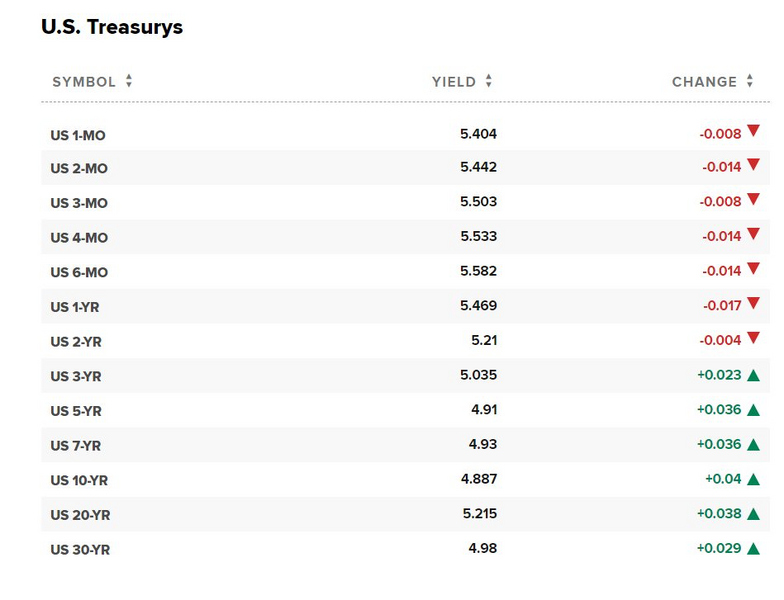

Last week, the dividend yield on the S&P500 was lower than the 10 year Treasury yield. What is the excess of beta for the market over the ten year Treasury? Yes, there are other elements of return to holding the equity, including capital gains/growth, but when the cash yield on a portfolio with a beta of 1 is roughly the same as the cash yield on a security with a beta probably 1/5th that, I start to wonder.

Seeking education here. How does the market have "excess beta" when I thought the market was the benchmark for beta = 1 and individual stocks were given a beta relative to the market's beta = 1?

gnatty8

Stylish Dinosaur

- Joined

- Nov 12, 2006

- Messages

- 12,657

- Reaction score

- 6,185

Really? I'd be surprised if Dow did not hit 35k in 2021

Shiller's PE10 is right around the 98th percentile right now. Of course it hit 44 right before the tech bubble burst, so 35K is not outside the realm of possibility. The question is does it stay there and if so, what does that imply for equity prices over the next 10 years. At a certain point, don't people ask themselves just what it is they are buying when they invest in a stock or index?

gnatty8

Stylish Dinosaur

- Joined

- Nov 12, 2006

- Messages

- 12,657

- Reaction score

- 6,185

Seeking education here. How does the market have "excess beta" when I thought the market was the benchmark for beta = 1 and individual stocks were given a beta relative to the market's beta = 1?

I mean beta relative to the 10 year Treasury

gnatty8

Stylish Dinosaur

- Joined

- Nov 12, 2006

- Messages

- 12,657

- Reaction score

- 6,185

I'd rather you do some minimal speaking so I don't have figure it out.

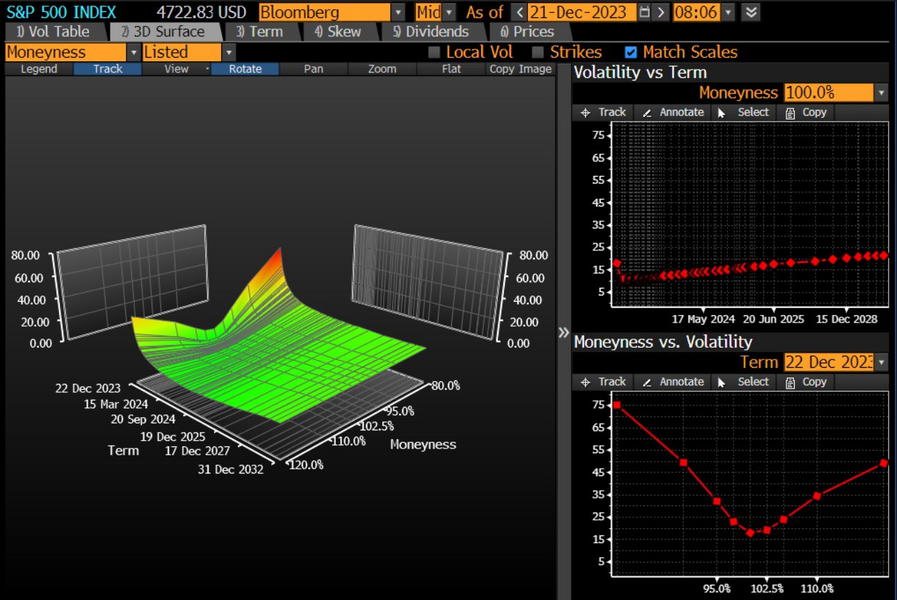

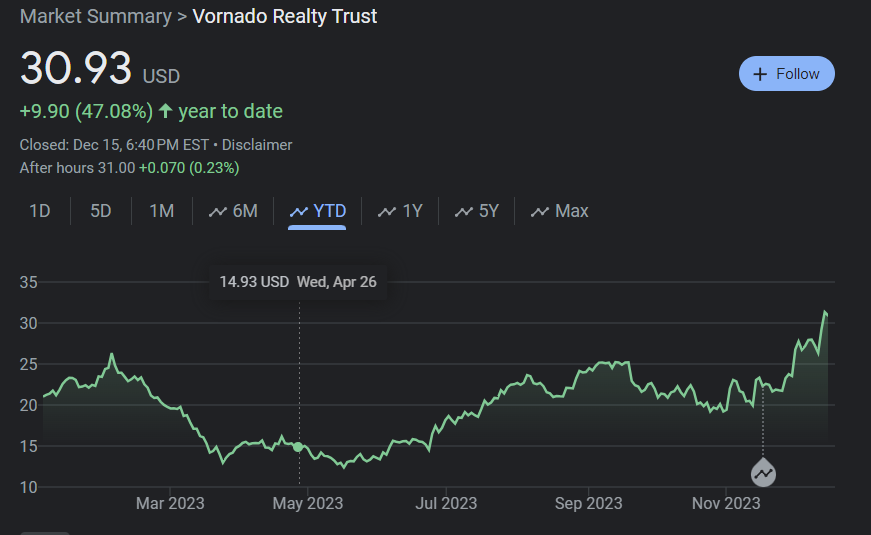

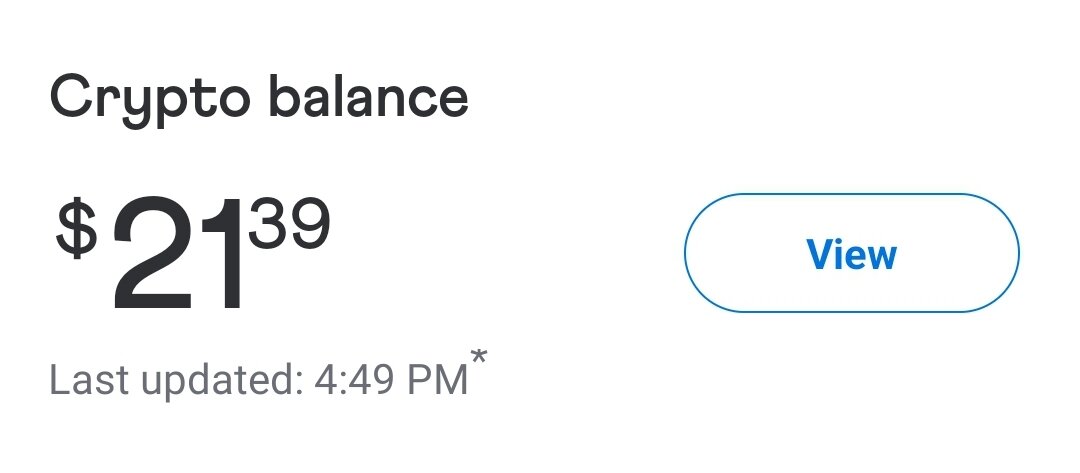

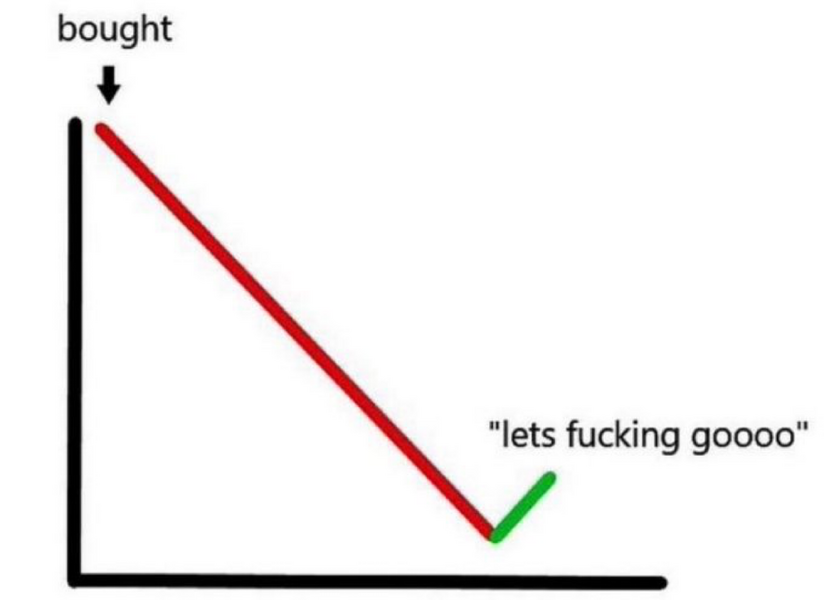

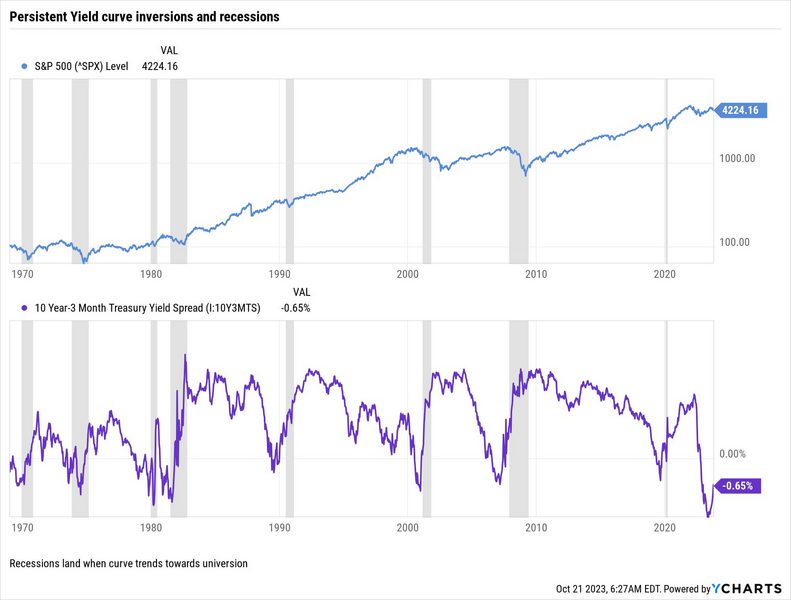

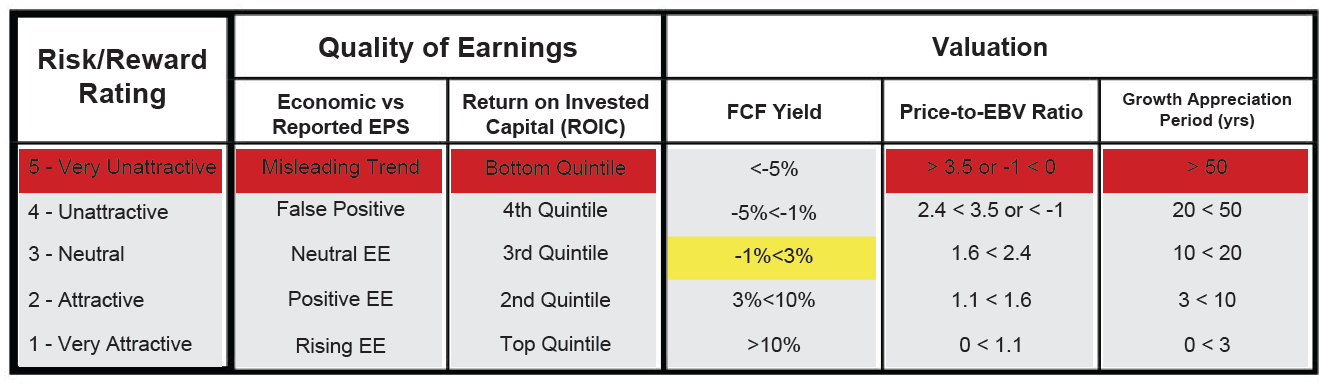

Come on now, a picture is worth a thousands words, so I've given you 3,000 from the kindness of my heart

gnatty8

Stylish Dinosaur

- Joined

- Nov 12, 2006

- Messages

- 12,657

- Reaction score

- 6,185

People always bring up the Shiller PE as some bell to ring. Now without looking, what was the Shiller PE at the bottom in 2009? How long did it stay below the average Shiller PE at the time?

Currently, we are close to 3 standard deviations above the long term geometric mean. In 2009, the measure bottomed out well short of 1 standard deviation below that long term mean.

- Joined

- Jun 9, 2005

- Messages

- 45,619

- Reaction score

- 54,462

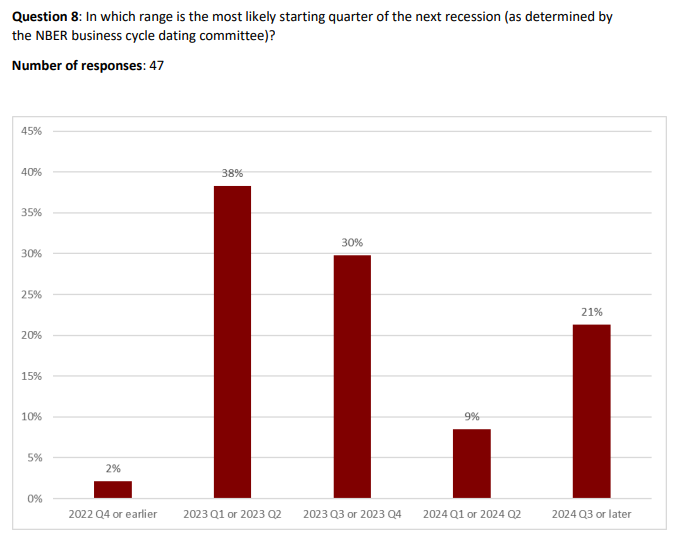

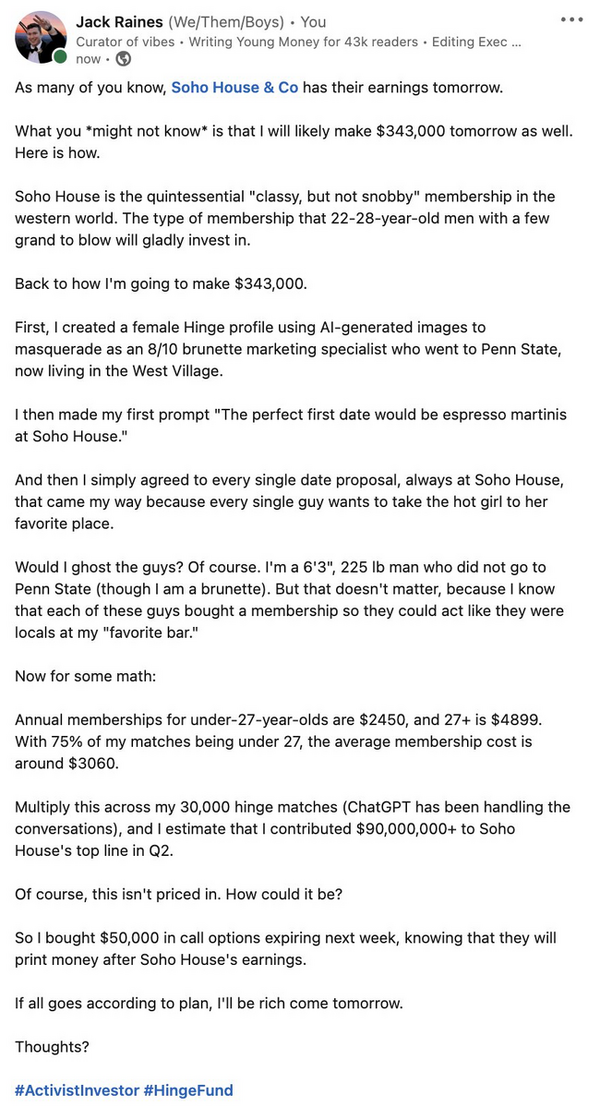

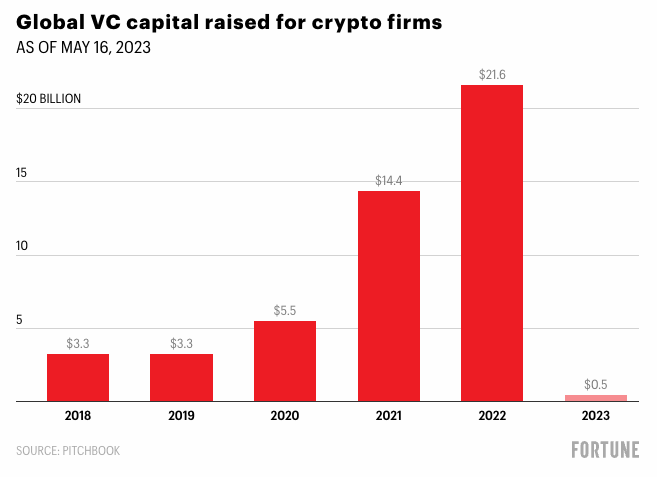

Are the graphs meant to illustrate all the dumb money going into the market? Maybe reminiscent of 1999 and all the retail money day trading on all those new E-Trade types of platforms?Come on now, a picture is worth a thousands words, so I've given you 3,000 from the kindness of my heart

I don't disagree that there's a Robinhood bubble somewhere in here. But I also think that we're on the verge of the most dramatic economic recovery curve we've ever seen in modern days. Monetary policy, stimulus spending, high consumer savings, pent up demand for entire segments of the economy, not to mention healthcare demand is now up a step function from pre-Covid, etc... Perfect storm scenario. There's a reason institutional investors are long this market. It has a significant potential for upside surprise.

(and I was taught financial markets by Roubini so I'm not always a rosy outlook guy)

- Joined

- Jun 9, 2005

- Messages

- 45,619

- Reaction score

- 54,462

With so much of the market's value in tech stocks, it's debatable how we should use historical PEs. Maybe we should split the market's cap between tech (and use historical PEG) and non tech (use historical PE) - and sum the partsCurrently, we are close to 3 standard deviations above the long term geometric mean. In 2009, the measure bottomed out well short of 1 standard deviation below that long term mean.

jbarwick

Distinguished Member

- Joined

- Nov 28, 2012

- Messages

- 8,719

- Reaction score

- 9,669

Be bearish then. You come out after a 5% drop and bang your bell the world is ending. It's very likely your hand sitting has cost you more money than calling any potential drop correctly. Plus, like last time you did this, you said you would be scared to buy-in thus capturing from your crystal ball calling.

See you again next time for another prediction. . .

See you again next time for another prediction. . .

Piobaire

Not left of center?

- Joined

- Dec 5, 2006

- Messages

- 81,812

- Reaction score

- 63,321

Are the graphs meant to illustrate all the dumb money going into the market? Maybe reminiscent of 1999 and all the retail money day trading on all those new E-Trade types of platforms?

I don't disagree that there's a Robinhood bubble somewhere in here. But I also think that we're on the verge of the most dramatic economic recovery curve we've ever seen in modern days. Monetary policy, stimulus spending, high consumer savings, pent up demand for entire segments of the economy, not to mention healthcare demand is now up a step function from pre-Covid, etc... Perfect storm scenario. There's a reason institutional investors are long this market. It has a significant potential for upside surprise.

(and I was taught financial markets by Roubini so I'm not always a rosy outlook guy)

There's been a thought we'll get our own "Roaring 20s" for exactly this reason, and not for nothing, the original R-20s came after the Spanish Flu pandemic.

nootje

Distinguished Member

- Joined

- Jul 14, 2008

- Messages

- 5,579

- Reaction score

- 5,278

Which came on the heels of mass mobilization and entire economies geared towards war returning to civilian live. I’ve heard that comparison a lot, but we where on the gold standard back then, trade patterns where very different and again, the world came out of a very destructive war.There's been a thought we'll get our own "Roaring 20s" for exactly this reason, and not for nothing, the original R-20s came after the Spanish Flu pandemic.

gnatty8

Stylish Dinosaur

- Joined

- Nov 12, 2006

- Messages

- 12,657

- Reaction score

- 6,185

Are the graphs meant to illustrate all the dumb money going into the market? Maybe reminiscent of 1999 and all the retail money day trading on all those new E-Trade types of platforms?

I don't disagree that there's a Robinhood bubble somewhere in here. But I also think that we're on the verge of the most dramatic economic recovery curve we've ever seen in modern days. Monetary policy, stimulus spending, high consumer savings, pent up demand for entire segments of the economy, not to mention healthcare demand is now up a step function from pre-Covid, etc... Perfect storm scenario. There's a reason institutional investors are long this market. It has a significant potential for upside surprise.

(and I was taught financial markets by Roubini so I'm not always a rosy outlook guy)

They were tongue in cheek, and not serious indicators of dumb money. Again, I tend to look at valuations, especially relative valuations. All of the factors you mention above will likely very much boost earnings/growth for the next year or two, but then what? If the market is a portfolio of individual equities, all based on the current risk-adjusted value of their future cash returns over a very long holding period, then those very short term positives - pent up demand, loose fiscal policy, loose monetary policy (all of which are also highly inflationary) show really only impact asset prices marginally. However, when we look at indicators of value (Tobin's Q, which is a measure of the "market to book" or market to replacement cost of assets, is at an all time high of close to 3X, compared to its previous peak (Tech-Bubble) of about 2.2X) like the CAPE ratio, market to book, P/E, whatever you want to refer to, they all just seem to lack sanity. Further, when I do a DCF on the S&P's current value, it implies an equity risk premium of about 180 bps! In other words, the amount of return we earn for assuming the risk of a basket of stocks relative to holding a Treasury is barely 2 percentage points. Over very long periods of the past, this has looked more like 6% to 7%. Most people I know would probably guess that this value should be 4% to 6%, and that is what they'd use in estimating their own WACC for hurdle rates and capital budgeting. Even using the bottom end of that range results in a 1 handle for the S&P500 at its current dividend yield.

Again, I'd be happy to be wrong, but I am just puzzled by these valuations and how we can make sense of them. In the mid-2000s I was offered a job in southern California, and as an "outsider", could not wrap my head around housing prices. Similarly, I just cannot do the same here, despite my attempts to do so.

gnatty8

Stylish Dinosaur

- Joined

- Nov 12, 2006

- Messages

- 12,657

- Reaction score

- 6,185

With so much of the market's value in tech stocks, it's debatable how we should use historical PEs. Maybe we should split the market's cap between tech (and use historical PEG) and non tech (use historical PE) - and sum the parts

Fair enough. I did a quick Google search and the FAANG stocks represent about 15% of the S&P500, so yes, a large part of the growth and poor valuations of the overall index are probably driven by these five alone, but most of us invest in indexes, not the S&P500 less FAANG so unless we are investing in individual stocks or small baskets of stocks with more reasonable valuations, as goes FAANG so goes 15% of the market. Also, I am not so sure we can just differentiate today's tech stocks from the Nifty Fifty of the last generation, or even the generation of tech stocks that fueled the prior bubble, which all had compelling stories and firm believers. At some point it becomes about productivity, producing things people need and want, and delivering on growth and eventually returning cash to investors.

FEATURED PRODUCTS

-

LuxeSwap Auction - De Bonne Facture Made France Plaid Boiled Robe Coat One of several De Bonne Facture robe coats featured this week, these pieces are being sold for our consignor in conjunction with our NMWA tradeup program - a forum first program that gets you several add ons for consigning and credits to shop at NMWA.

-

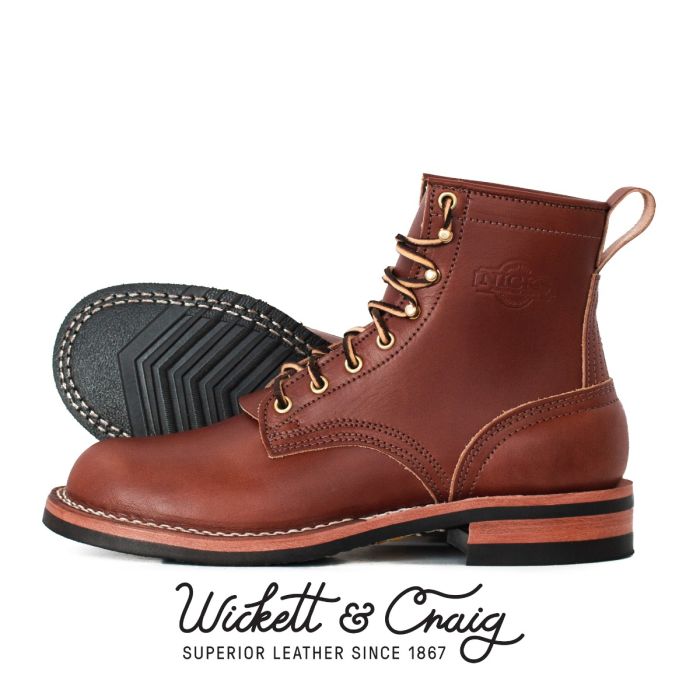

Nicks Boots - Wickett & Craig English Bridle Veg Tan Leather - $759

These boots are made from 6.5 oz Wickett & Craig English Bridle Leather. This tannery has been making leather the old fashioned way since 1867. Each side can take about six weeks to produce, making it a significantly longer production time than most leather on the market.

Nicks Boots - Wickett & Craig English Bridle Veg Tan Leather - $759

These boots are made from 6.5 oz Wickett & Craig English Bridle Leather. This tannery has been making leather the old fashioned way since 1867. Each side can take about six weeks to produce, making it a significantly longer production time than most leather on the market.

-

Besnard - Navy Cotton Skipper Polo - $180.00 This navy skipper polo is inspired by 1940s sportswear. It features a tailored fit and a slightly shorter body to accommodate high-waisted trousers or shorts.

Latest posts

- Replies

- 5,464

- Views

- 1,260,159

- Replies

- 0

- Views

- 1

- Replies

- 25,695

- Views

- 1,637,933

- Replies

- 84,194

- Views

- 12,428,923

Similar threads

- Replies

- 77

- Views

- 131,032

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Members online

- Father Style

- zippyh

- Hombre Secreto

- Beswick

- jorybeamer

- JayDee90

- remington

- FibroblastsMakeLeather

- TheLawBeard

- Letric

- Ambulance Chaser

- Camerashy

- triton

- Ralef

- shoewarma

- gonnagetmine

- thebeanieking

- kindofyoung

- Crafty Cumbrian

- ronnieadkins08

- Orrberget

- comrade

- archipel

- abambata

- alfred3

- Ace_Face

- spleenwort21

- teddieriley

- Nakedsnake

- tacostacostacos

- ScottyK

- amby16

- zann

- Houndtooth48

- lagsun

- aristoi bcn

- NickInTO

- malcb33

- ElliotG

- M.C.D.

- Texasmade

- Gibonius

- classicoutfits

- Equilibrum

- MeatFish

- JPG

- Numbernine

- T1mb0

- noverbeck

- McIsten

Total: 1,956 (members: 128, guests: 1,828)