- Joined

- May 30, 2013

- Messages

- 16,876

- Reaction score

- 38,597

It's happening again. My golf pro asked me if he should buy Bitcoin.

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

A rich cuck is still a cuck.Idfnl is about to get rich again.

Further.

It's happening again. My golf pro asked me if he should buy Bitcoin.

Thank you for the info. I've been diving into the whole Boglehead thing and picked up/read "The Simple Path to Wealth". I've noticed that there seems to be a split between "Put everything in index funds" and the 2 and 3 fund portfolios that include bonds and other more secure investments. Since I will have a teacher pension and my wife and I will both inherit some property eventually, I was leaning toward just having our Roth IRAs and her 401k all in VOO/VTI/equivalent. That would shift as we get older (I'm 36 and she's 33) but for now it seems like we are just reducing our upside. We are fully onboard with 'stay the long term, keep investing every year, don't panic, low expense index funds, save a lot of money' etc.

Buy low sell high. Can't be that hardI think Imma become a day trader. This market timing **** is easy.

Just remember which way the alligators are pointing. That is key to understanding day tradingInorite?

Just remember which way the alligators are pointing. That is key to understanding day trading

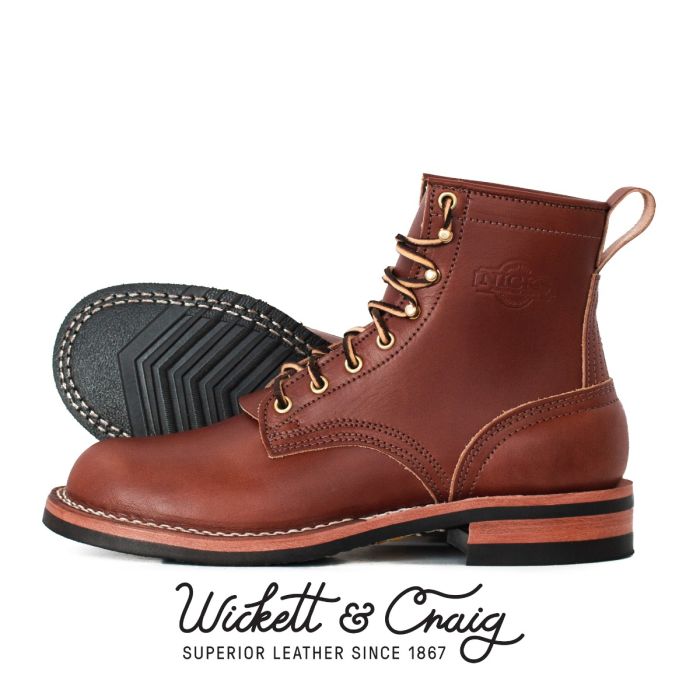

Nicks Boots - Wickett & Craig English Bridle Veg Tan Leather - $759

These boots are made from 6.5 oz Wickett & Craig English Bridle Leather. This tannery has been making leather the old fashioned way since 1867. Each side can take about six weeks to produce, making it a significantly longer production time than most leather on the market.

Nicks Boots - Wickett & Craig English Bridle Veg Tan Leather - $759

These boots are made from 6.5 oz Wickett & Craig English Bridle Leather. This tannery has been making leather the old fashioned way since 1867. Each side can take about six weeks to produce, making it a significantly longer production time than most leather on the market.