- Joined

- Oct 16, 2006

- Messages

- 38,393

- Reaction score

- 13,643

I just found out that shares awarded to me years back are now vested. Sell share. Buy shoes. BOOM.

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

How confident are you in a successful exit?

Rough life when you cannot fund the exercise price and makes sense that a company takes 80% for people that go that route.

I’m not certain that the company will have a successful exit. A relatively small swing in transaction value could have a big impact on my share value. So it’s not so much that I can’t afford to exercise, it’s just that I’m not certain it’s a good investment and would tie up a lot of free cash until an exit happens. That said, the total value could be significant so I don’t just want to walk away with nothing.

I’m working every angle at this point.

Interesting article on how you can fund a Roth IRA with after-tax 401k plan contributions. This is not universally available but something worth looking into if you are phased out of Roth contributions and you max out pre-tax 401k contributions. I still have a few years before I have to worry about this but would be able to take advantage of at least part of this based on my wife's 401k plan.

https://humbledollar.com/2018/10/seeking-zero/

Interesting article on how you can fund a Roth IRA with after-tax 401k plan contributions. This is not universally available but something worth looking into if you are phased out of Roth contributions and you max out pre-tax 401k contributions. I still have a few years before I have to worry about this but would be able to take advantage of at least part of this based on my wife's 401k plan.

https://humbledollar.com/2018/10/seeking-zero/

I’m in this boat. This is interesting but I worry that point 2 would trip me up - I’m terrible about tracking this kind of stuff long-term.

60% of the time, it works every time.Sounds like I need to first complete Step #1: Make more money.

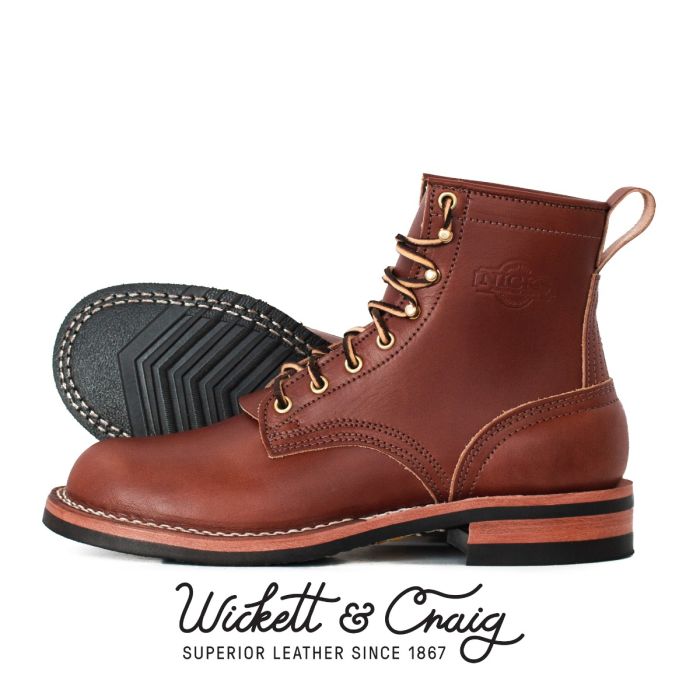

Nicks Boots - Wickett & Craig English Bridle Veg Tan Leather - $759

These boots are made from 6.5 oz Wickett & Craig English Bridle Leather. This tannery has been making leather the old fashioned way since 1867. Each side can take about six weeks to produce, making it a significantly longer production time than most leather on the market.

Nicks Boots - Wickett & Craig English Bridle Veg Tan Leather - $759

These boots are made from 6.5 oz Wickett & Craig English Bridle Leather. This tannery has been making leather the old fashioned way since 1867. Each side can take about six weeks to produce, making it a significantly longer production time than most leather on the market.