idfnl

Stylish Dinosaur

- Joined

- Dec 6, 2008

- Messages

- 17,305

- Reaction score

- 1,260

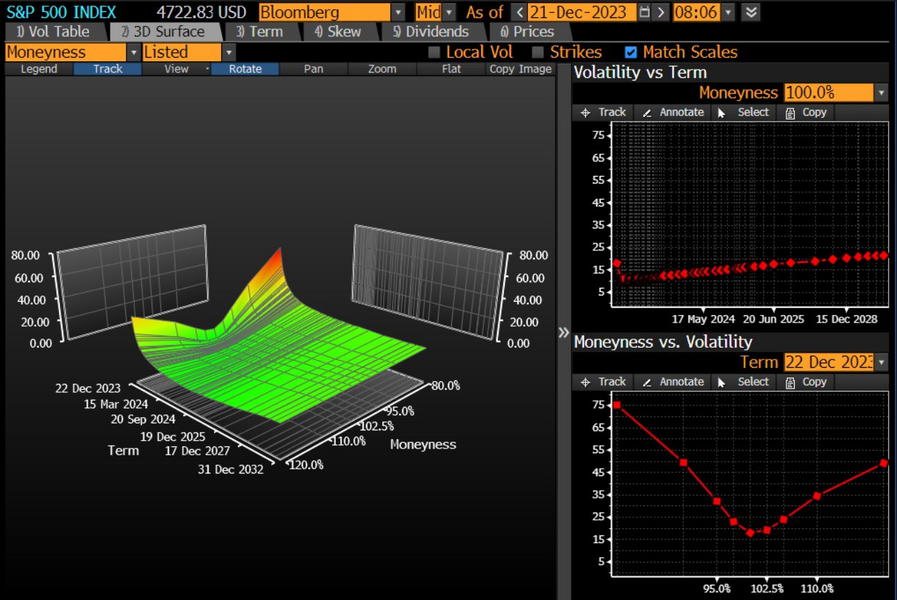

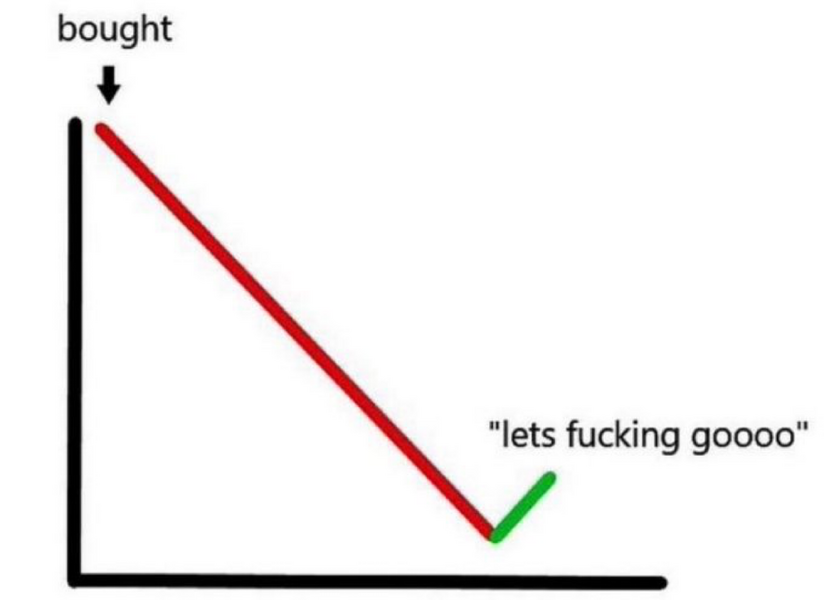

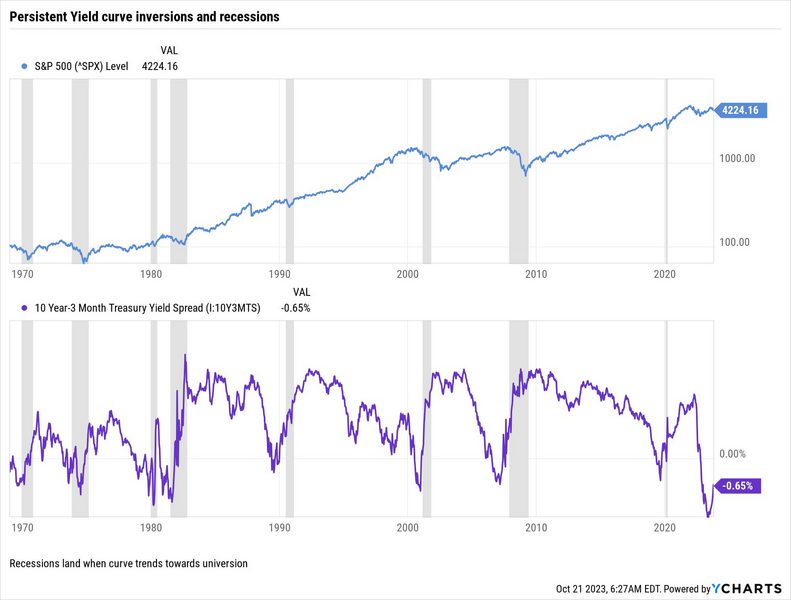

You can make a chart do circles by plugging in the convenient tool or looking at the right timeline, etc to make a story look compelling. Agree completely. But there are some pretty well established chart signals that a lot of traders and automated platforms move on such as the 200 day moving average.

You prly know what a candlestick chart does, but just in case, its useful because it tells you 4 things, the open, high, low and close of a price for any given duration. It's a good way to measure volatility and identify support or loss thereof. If a candlestick is uncolored, it means the close was higher than the open, and dark means the opposite. In conjunction with, for example, a bollinger band, it can tell you when the price is *looking* overbought or sold, and *might* be a good time to enter or exit.

Most recently, I took a small stake in UPS, and I opened the 2 minute chart to see what it looked like that day. It was in the middle of the band, on a series of dark candles, indicating that it had a bit more selling off to do before an uptick. So I set my price like $0.11 below the current and withing about 5 minutes I got it. I could have just bought and not cared about that tiny amount, but I get a kick out of it. Of course it went down further that day but I got a small discount in the time window I had available.

Yeah, I know. I was obviously pimping you a bit. But I do think that one of the insidious things about technical analysis and the like is they use fancy names like "technical analysis" and use lots of numbers and charts so people feel like they're being analytic, when if facts it's all (in my opinion) goofy-assed magical thinking BS.

But maybe that's because I could never tell a candle chart from a stalagmite chart from a rocket ship chart.

You can make a chart do circles by plugging in the convenient tool or looking at the right timeline, etc to make a story look compelling. Agree completely. But there are some pretty well established chart signals that a lot of traders and automated platforms move on such as the 200 day moving average.

You prly know what a candlestick chart does, but just in case, its useful because it tells you 4 things, the open, high, low and close of a price for any given duration. It's a good way to measure volatility and identify support or loss thereof. If a candlestick is uncolored, it means the close was higher than the open, and dark means the opposite. In conjunction with, for example, a bollinger band, it can tell you when the price is *looking* overbought or sold, and *might* be a good time to enter or exit.

Most recently, I took a small stake in UPS, and I opened the 2 minute chart to see what it looked like that day. It was in the middle of the band, on a series of dark candles, indicating that it had a bit more selling off to do before an uptick. So I set my price like $0.11 below the current and withing about 5 minutes I got it. I could have just bought and not cared about that tiny amount, but I get a kick out of it. Of course it went down further that day but I got a small discount in the time window I had available.

Last edited: