Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is business dress clothing tax deductible?

- Thread starter ballines

- Start date

- Watchers 0

Alias

Distinguished Member

- Joined

- Oct 7, 2003

- Messages

- 1,662

- Reaction score

- 321

I think they allow you an itemized deduction for expenses for work uniforms. Work uniforms are clothes that you wear on the job only that are not suitable for everyday use. I would argue that suits are wearable even when you're not on the job; it's not like you're walking around in a fast food restaurant uniform. So I don't think so.

imageWIS

Stylish Dinosaur

- Joined

- Apr 19, 2004

- Messages

- 19,716

- Reaction score

- 106

...and while you are in front of the IRS auditor and he looks up at you with a perplexed and puzzled / troubled expression on his face says "I see here you purchased 3 "˜Ke-TON' suits for a total of $13,500..."

Jon. P.S. Did I mention that I am not a tax attorney?

Jon. P.S. Did I mention that I am not a tax attorney?

regularjoe

Senior Member

- Joined

- Feb 2, 2004

- Messages

- 276

- Reaction score

- 0

I wish.Any chance I'm lucky enough that these expenses are considered tax deductible business expenses?

If Congress ever made it so, I can imagine participation on this forum would drop as everybody would be to busy shopping.

marc237

Distinguished Member

- Joined

- Apr 4, 2004

- Messages

- 2,353

- Reaction score

- 3

Sorry, generally not. Â While I cannot give legal or tax advice over the internet, I can tell you that the IRS view is that: Work Clothes and Uniforms You can deduct the cost and upkeep of work clothes if the following two requirements are met. You must wear them as a condition of your employment. The clothes are not suitable for everyday wear. It is not enough that you wear distinctive clothing. The clothing must be specifically required by your employer. Nor is it enough that you do not, in fact, wear your work clothes away from work. The clothing must not be suitable for taking the place of your regular clothing. Examples of workers who may be able to deduct the cost and upkeep of work clothes are: delivery workers, firefighters, health care workers, law enforcement officers, letter carriers, professional athletes, and transportation workers (air, rail, bus, etc.). Musicians and entertainers can deduct the cost of theatrical clothing and accessories that are not suitable for everyday wear. However, work clothing consisting of white cap, white shirt or white jacket, white bib overalls, and standard work shoes, which a painter is required by his union to wear on the job, is not distinctive in character or in the nature of a uniform. Similarly, the costs of buying and maintaining blue work clothes worn by a welder at the request of a foreman are not deductible. Protective clothing. Â You can deduct the cost of protective clothing required in your work, such as safety shoes or boots, safety glasses, hard hats, and work gloves. Examples of workers who may be required to wear safety items are: carpenters, cement workers, chemical workers, electricians, fishing boat crew members, machinists, oil field workers, pipe fitters, steamfitters, and truck drivers. See ]http://www.irs.gov/publications/p529/ar02.html#d0e253

BGW

Senior Member

- Joined

- Mar 1, 2004

- Messages

- 107

- Reaction score

- 0

"You may be able to deduct the following items as unreimbursed employee expenses: Work clothes and uniforms if required and not suitable for everyday use."

My question is this:

What if you contracted with your employer that as a condition of your employment you could not wear your designated work clothes outside of the office?

I guess this all hinges on what the word "suitable" means.

My question is this:

What if you contracted with your employer that as a condition of your employment you could not wear your designated work clothes outside of the office?

I guess this all hinges on what the word "suitable" means.

marc237

Distinguished Member

- Joined

- Apr 4, 2004

- Messages

- 2,353

- Reaction score

- 3

I am told that the IRS takes a dim view of collusive efforts to evade taxes. Probably better off donating that Kiton SB to charity and taking the deduction for that."You may be able to deduct the following items as unreimbursed employee expenses: Work clothes and uniforms if required and not suitable for everyday use."

My question is this:

What if you contracted with your employer that as a condition of your employment you could not wear your designated work clothes outside of the office?

I guess this all hinges on what the word "suitable" means.

discostu004

Affiliate vendor

- Joined

- Apr 5, 2004

- Messages

- 1,841

- Reaction score

- 15

hey mark, not to hijack this thread, but you sound like a tax person: what about the SUV tax deduction form last year? i hear it hasn't been changed, therefore those who file a schedule c can take advantage this year. if the IRS does make a change:

1. what month do they usually do that?

2. do they grandfather in, i.e. someone buys a tahoe in may and they change the law in sept, can you still take the deduction since you bought it at a time when the law was still in effect

i know it's in irs.gov, but i can't find anything specific and if i can i'd like to start looking for something and also look for someone to buy my tahoe i have now

thx

1. what month do they usually do that?

2. do they grandfather in, i.e. someone buys a tahoe in may and they change the law in sept, can you still take the deduction since you bought it at a time when the law was still in effect

i know it's in irs.gov, but i can't find anything specific and if i can i'd like to start looking for something and also look for someone to buy my tahoe i have now

thx

montecristo#4

Stylish Dinosaur

- Joined

- Jan 7, 2004

- Messages

- 12,214

- Reaction score

- 21

There is actually a pretty well-known tax case about a woman who worked in a high-end boutique who deducted the cost of her clothes. Obviously, as part of her job she was required to wear the clothes carried by the boutique. If I remember correctly, her deduction was not permitted.

marc237

Distinguished Member

- Joined

- Apr 4, 2004

- Messages

- 2,353

- Reaction score

- 3

Sorry, not a tax lawyer. I just happen to be fairly familiar with business deductions.hey mark, not to hijack this thread, but you sound like a tax person: what about the SUV tax deduction form last year? Â i hear it hasn't been changed, therefore those who file a schedule c can take advantage this year. Â if the IRS does make a change:

1. what month do they usually do that?

2. do they grandfather in, i.e. someone buys a tahoe in may and they change the law in sept, can you still take the deduction since you bought it at a time when the law was still in effect

i know it's in irs.gov, but i can't find anything specific and if i can i'd like to start looking for something and also look for someone to buy my tahoe i have now

thx

BGW

Senior Member

- Joined

- Mar 1, 2004

- Messages

- 107

- Reaction score

- 0

You are right about the boutique case -- I actually looked this very subject up one time.

The contract provision I hypothesized is not per se a sham. There is a legitimate business purpose for an employer only allowing a worker to wear a particular item of business clothing to work. It prevents the item from prematurely aging or becoming filthy.

The contract provision I hypothesized is not per se a sham. There is a legitimate business purpose for an employer only allowing a worker to wear a particular item of business clothing to work. It prevents the item from prematurely aging or becoming filthy.

johnnynorman3

Distinguished Member

- Joined

- Mar 3, 2004

- Messages

- 2,702

- Reaction score

- 25

I just PMed the starter of this thread the rundown of this case. It was actually Yves St. Laurent -- a woman who worked in their retail store tried to take the deduction, arguing that she would never wear YSL clothes outside of work because she found them "pretentious." She lost.There is actually a pretty well-known tax case about a woman who worked in a high-end boutique who deducted the cost of her clothes. Obviously, as part of her job she was required to wear the clothes carried by the boutique. If I remember correctly, her deduction was not permitted.

- Joined

- Dec 26, 2003

- Messages

- 3,794

- Reaction score

- 1,021

Many years ago there was a short lived scam that allowed you to lease your suits. The IRS Shut this one down quickly.

kabert

Distinguished Member

- Joined

- Feb 23, 2004

- Messages

- 2,078

- Reaction score

- 7

How about starting a clothing "business" -- an EBay "business" perhaps -- in which you have to buy clothes to re-sell on EBay, etc. Those business expenses could arguably be tax deductible; who's to know if you happen to wear some of the clothes while waiting for someone to buy them in an EBay auction. As long as you can show an actual profit motive and records of a decent number of sales, it at least wouldn't look too outlandishly fishy from the perspective of an IRS auditor. {Just a wild thought.}

FEATURED PRODUCTS

-

LuxeSwap Auction - Kiton Napoli 100% GUANACO Camel Flannel DB Top Coat

A virtual unicorn, this 100% pure Guanaco double breasted top coat by Kiton combines one of the worlds rarest fabrics with one of the worlds most exclusive brands. Retail on this item was deep in the double digits, and is being offered at auction with a $9.99 starting bid with no reserve.

LuxeSwap Auction - Kiton Napoli 100% GUANACO Camel Flannel DB Top Coat

A virtual unicorn, this 100% pure Guanaco double breasted top coat by Kiton combines one of the worlds rarest fabrics with one of the worlds most exclusive brands. Retail on this item was deep in the double digits, and is being offered at auction with a $9.99 starting bid with no reserve.

-

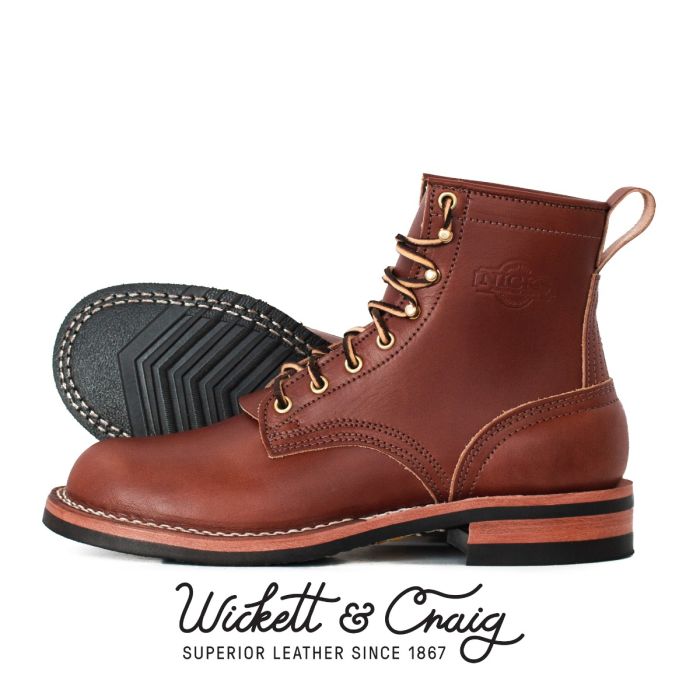

Nicks Boots - Wickett & Craig English Bridle Veg Tan Leather - $759

These boots are made from 6.5 oz Wickett & Craig English Bridle Leather. This tannery has been making leather the old fashioned way since 1867. Each side can take about six weeks to produce, making it a significantly longer production time than most leather on the market.

Nicks Boots - Wickett & Craig English Bridle Veg Tan Leather - $759

These boots are made from 6.5 oz Wickett & Craig English Bridle Leather. This tannery has been making leather the old fashioned way since 1867. Each side can take about six weeks to produce, making it a significantly longer production time than most leather on the market.

-

Besnard - Made to Order Trousers - $351 Design your ideal pair of trousers by selecting a fabric, deciding between single or double pleats, choosing a zip or button fly, and opting for side adjusters or belt loops.

Latest posts

- Replies

- 1

- Views

- 212

- Replies

- 0

- Views

- 1

- Replies

- 1,596

- Views

- 530,593

- Replies

- 27,438

- Views

- 4,309,705

Similar threads

- Replies

- 1

- Views

- 575

- Replies

- 0

- Views

- 494

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett