- Joined

- Jun 9, 2005

- Messages

- 45,620

- Reaction score

- 54,467

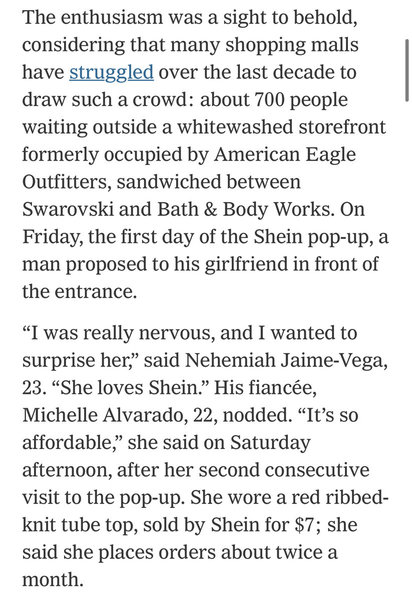

For one person willing to spend $1k for hot sneakers, there are many many more who want them as much (maybe more) but cannot afford that. People rotate out of their sneakers and look to ways to monetize stuff they don't wear to make room for the latest stuff they want. The second sneaker market is nowhere nearly as efficient as the BNIB resale market so there's unmet demand for a service that can operate that rotation. Added benefit: sneaker rental businesses could be both buyers and sellers of shoes that don't qualify for resale platforms (worn).

Ownership of goods is effectively dissociated from enjoyment for so much of what we spend already - I can see very few mental barriers, especially for younger consumers, to renting objects that are not expected to be used/worn for a long period of time.

Not saying that this particular business, its model or its pricing are right for that. No idea.

Ownership of goods is effectively dissociated from enjoyment for so much of what we spend already - I can see very few mental barriers, especially for younger consumers, to renting objects that are not expected to be used/worn for a long period of time.

Not saying that this particular business, its model or its pricing are right for that. No idea.