Support the forum

Navigation

-

- Men's Style

- Classic Menswear

- Streetwear and Denim

- Preorders, Group Made-to-order, trunk shows, and o

- Menswear Advice

- Former Affiliate Vendor Threads; a Locked Forum.

- Career and job listings in fashion, mens clothing,

-

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Install the app

More options

-

Hi, I am the owner and main administrator of Styleforum. If you find the forum useful and fun, please help support it by buying through the posted links on the forum. Our main, very popular sales thread, where the latest and best sales are listed, are posted HERE

Purchases made through some of our links earns a commission for the forum and allows us to do the work of maintaining and improving it. Finally, thanks for being a part of this community. We realize that there are many choices today on the internet, and we have all of you to thank for making Styleforum the foremost destination for discussions of menswear. -

This site contains affiliate links for which Styleforum may be compensated.

-

STYLE. COMMUNITY. GREAT CLOTHING.

Bored of counting likes on social networks? At Styleforum, you’ll find rousing discussions that go beyond strings of emojis.

Click Here to join Styleforum's thousands of style enthusiasts today!

Styleforum is supported in part by commission earning affiliate links sitewide. Please support us by using them. You may learn more here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

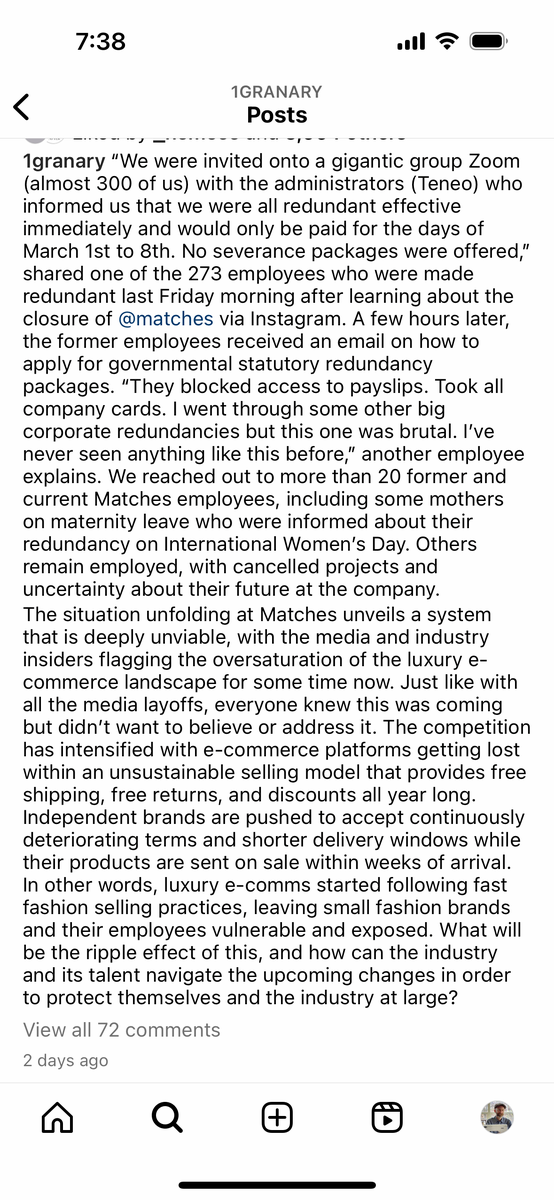

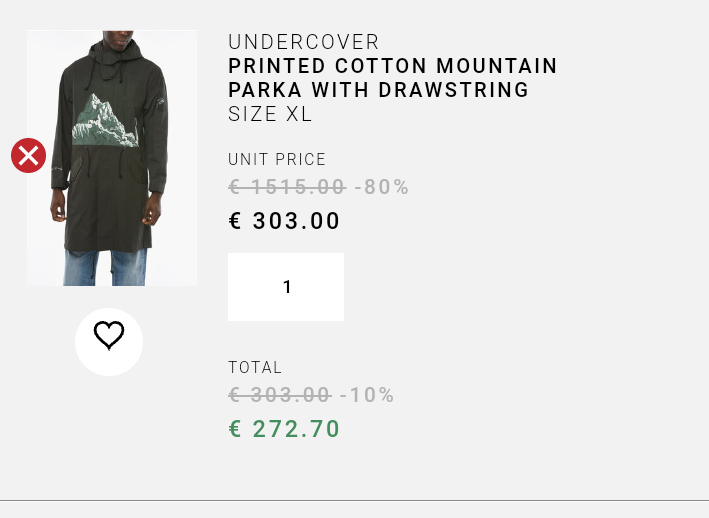

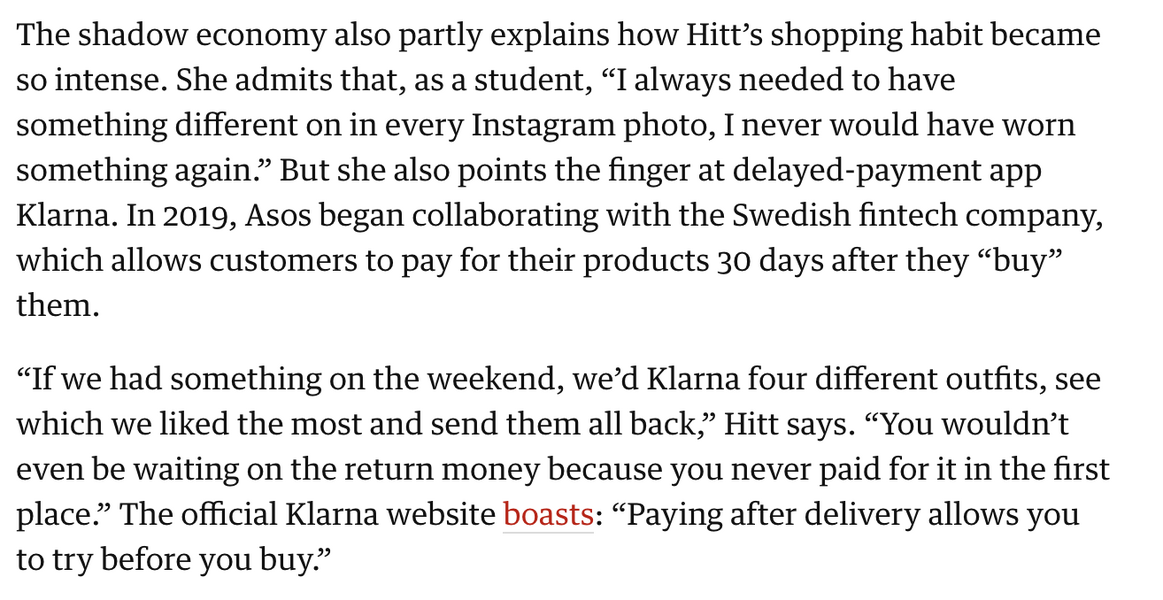

Discussions about the fashion industry thread

- Thread starter LA Guy

- Start date

- Watchers 358

Todd Shelton

Senior Member

- Joined

- Oct 14, 2016

- Messages

- 500

- Reaction score

- 303

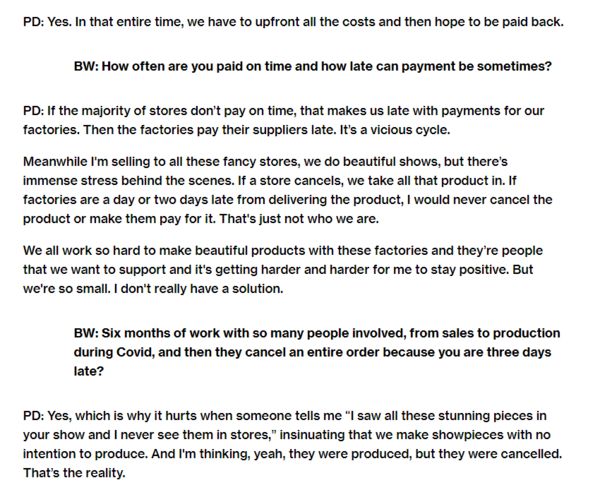

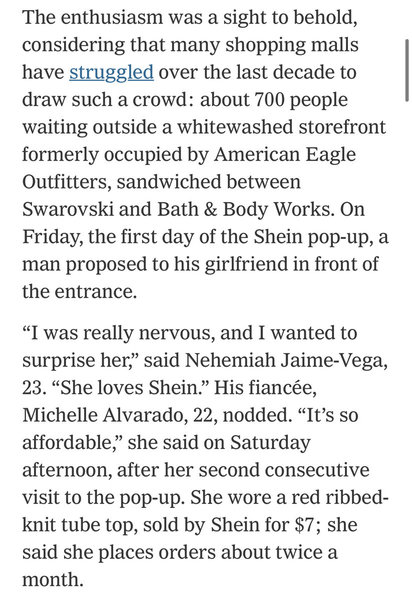

Outdoor voices founder steps down as CEO. I think she had a good idea and the timing was right for her brand. Seems I'm reading more about young DTC brands taking a lot of VC money, not knowing exactly how to manage that money, and getting into trouble. I would've liked to have seen her go a bit slower and build on the niche, unique brand she started instead of talking about going mass-market, etc.

- $60 million in funding since 2014

- $2 million a month burn rate in 2019, with $40 million in annual sales

- APC's Jean Touitou invested in 2016

- Mickey Drexler was an investor and chairman of the board in 2017 but resigned after concerns about the brand in 2019

Paywall

:quality(70):focal(-5x-5:5x5)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/NGM54RUDFFFVFMPFAUIYZPKQ2E.jpg)

www.businessoffashion.com

www.businessoffashion.com

- $60 million in funding since 2014

- $2 million a month burn rate in 2019, with $40 million in annual sales

- APC's Jean Touitou invested in 2016

- Mickey Drexler was an investor and chairman of the board in 2017 but resigned after concerns about the brand in 2019

Paywall

:quality(70):focal(-5x-5:5x5)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/NGM54RUDFFFVFMPFAUIYZPKQ2E.jpg)

Inside the Outdoor Voices Saga

Existing investors, including General Catalyst, have provided a lifeline for the activewear label, which continues to lose money on customer acquisition as it struggles to broaden its audience.

cb200

Distinguished Member

- Joined

- Jan 30, 2010

- Messages

- 1,422

- Reaction score

- 1,973

Not surprised at the removal of the CEO. Taking on investors is good as it demands accountability and results in a way that may not be part of the operational core of a clothing brand. And it can really help finance growth for a DTC brand when they can't use traditional forms of financing like factoring. They jumped over a big chasm from 7 to 8 figures in sales with that financing. Many won't cross that chasm- ever even with extra cash. But the timelines and returns needed for "big" VC investors - I don't think work for apparel. The clock starts for an exit, of some sort, the day funding rounds get announced. I'm guessing the phrase "the next lululemon" is getting mothballed from pitches to investors from now on.

- Joined

- Mar 14, 2019

- Messages

- 4,081

- Reaction score

- 5,956

Besides working in private label fashion, I also am (lightly involved) in a mobile gambling startup.

Problem with all these startups is they spend money like sailors in port.

Best offices, best furniture, best everything.

Like us.... we have 100 employees in california in a warehouse and an old school office. Then we have 4 salesmen in a ridiculous times square showroom. Only one of those 3 places is fancy.

As an investor I would never back an apparel startup. Tech is at least in silly money, but given the environment around apparel, production chain, market saturation etc I cant imagine throwing money at a new DTC.

Problem with all these startups is they spend money like sailors in port.

Best offices, best furniture, best everything.

Like us.... we have 100 employees in california in a warehouse and an old school office. Then we have 4 salesmen in a ridiculous times square showroom. Only one of those 3 places is fancy.

As an investor I would never back an apparel startup. Tech is at least in silly money, but given the environment around apparel, production chain, market saturation etc I cant imagine throwing money at a new DTC.

- Joined

- Mar 8, 2002

- Messages

- 57,571

- Reaction score

- 36,416

Problem with all these startups is they spend money like sailors in port.

Best offices, best furniture, best everything.

I've seen this, and I think that a lot of it is that the money is given out too freely, to people who are too young and inexperienced. I've seen this a lot. There is basically no reason you need an office fill of Aeron chairs and expensive leather furniture and free beverages and whatever non-productive crap fills some Stanford grad's start up wet dream. It should come as no surprise, either. I mean, these are guys, 25-28, and they have a good idea, but they've been previously living staying in a dive and subsisting on ramen. Getting VC backing feels like the equivalent of winning Powerball, and guys act as if they have.

One thing that I've always liked about Amazon (should have invested earlier than I did) is that at core, their two earners - consumer retail and web hosting, are low margin businesses, and force fiscal restraint. A lot of other companies, with high margins, it's pretty easy to lose sight of what is a good and what is a bad expense.

bry2000

Stylish Dinosaur

- Joined

- Oct 22, 2004

- Messages

- 10,039

- Reaction score

- 8,998

Amazon was never lacking for capital or access to capital.

These newly funded startups spend like crazy not only because of vanity but also because they believe they need to offer the perks and amenities to attract talent. They believe they are signaling success by having the right office decor, catered meals, etc. And because the other firms competing for the same workers are probably offering those perks and amenities as well. Bit of a wasteful arms race.

These newly funded startups spend like crazy not only because of vanity but also because they believe they need to offer the perks and amenities to attract talent. They believe they are signaling success by having the right office decor, catered meals, etc. And because the other firms competing for the same workers are probably offering those perks and amenities as well. Bit of a wasteful arms race.

happyriverz

Senior Member

- Joined

- Jan 19, 2016

- Messages

- 717

- Reaction score

- 1,419

The world is awash in dry powder looking for yield, so the startups are just meeting a demand.

- Joined

- Mar 8, 2002

- Messages

- 57,571

- Reaction score

- 36,416

I feel that it’s diminishing returns. I see it happening on Series B or later funding. That means that you already have your gang of killers, and anyone who will join that core group is not going to come aboard because of the excellent treats or the sweet offices.Amazon was never lacking for capital or access to capital.

These newly funded startups spend like crazy not only because of vanity but also because they believe they need to offer the perks and amenities to attract talent. They believe they are signaling success by having the right office decor, catered meals, etc. And because the other firms competing for the same workers are probably offering those perks and amenities as well. Bit of a wasteful arms race.

bry2000

Stylish Dinosaur

- Joined

- Oct 22, 2004

- Messages

- 10,039

- Reaction score

- 8,998

Remember we are essentially talking about millennials.I feel that it’s diminishing returns. I see it happening on Series B or later funding. That means that you already have your gang of killers, and anyone who will join that core group is not going to come aboard because of the excellent treats or the sweet offices.

- Joined

- Jul 13, 2012

- Messages

- 20,205

- Reaction score

- 33,397

Raf Simons Becomes Co-Creative Director at Prada (Published 2020)

The move, which could reshape the fashion universe, will be the first such long-term power-sharing by creative equals at a major public brand.

GG Allin

Distinguished Member

- Joined

- Apr 5, 2012

- Messages

- 2,062

- Reaction score

- 2,055

I feel like this is terrible news.

Raf Simons Becomes Co-Creative Director at Prada (Published 2020)

The move, which could reshape the fashion universe, will be the first such long-term power-sharing by creative equals at a major public brand.www.nytimes.com

Nyarlathotep

Distinguished Member

- Joined

- Jun 23, 2018

- Messages

- 1,195

- Reaction score

- 1,171

Raf has that kiss of death.

OccultaVexillum

Stylish Dinosaur

- Joined

- Aug 1, 2013

- Messages

- 10,969

- Reaction score

- 12,226

I like Prada, i'm indifferent on Raf.

Well, actually that's not true. I think he's very overrated and hasn't done anything consistently good outside of his time at Jil, but i attribute that more to my tastes rather than his talent.

I think Prada is probably more in line with Rafs aethetic than Jil or even CK were though.

Well, actually that's not true. I think he's very overrated and hasn't done anything consistently good outside of his time at Jil, but i attribute that more to my tastes rather than his talent.

I think Prada is probably more in line with Rafs aethetic than Jil or even CK were though.

Streetwear Featured products

-

Wellington Chore Boot - Special Introductory Price! $495 Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

Wellington Chore Boot - Special Introductory Price! $495 Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way. -

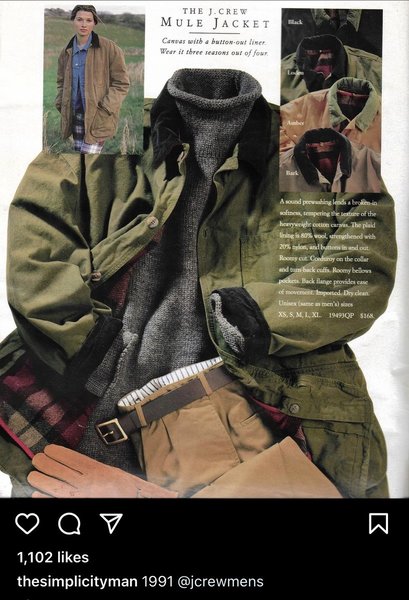

T-shirts Uncovered: UNIFORM/LA - Vintage Black Crew Neck T-shirt - $54 This Made-in-USA tee blends the classic 80s band look with a modern, work-friendly twist. Feel the comfort, embrace the vintage vibes, and bring a little rock ‘n’ roll to your everyday wardrobe.

-

T-shirt Uncovered: UNIFORM/LA - Heavyweight Artist Tee - $64 Crafted with creativity in mind—this heavyweight tee is the canvas for your imagination. Made in the USA with 12.5 oz of premium supima cotton, it’s the perfect choice for those who turn inspiration into art.

FEATURED PRODUCTS

-

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket

A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

LuxeSwap Auction - Vintage Antique United States Naval Navy Denim Deck Jacket

A piece for denim heads, vintage collectors, streetwear enthusiasts and menswear enthusiasts alike, this extremely rare early US Naval issued deck jacket in raw denim is not likely to ever show up at auction again anytime soon. A Haleys Comet of menswear items, offered at auction at a $9.99 starting bid with no reserve.

-

Wellington Chore Boot - Special Introductory Price! $495

Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

Wellington Chore Boot - Special Introductory Price! $495

Introducing the latest addition to Nicks Handmade Boots collection: The Wellington Chore Boot. Engineered for the rigors of daily tasks, this boot is more than just footwear; it's a reliable companion for your everyday adventures. Crafted with convenience in mind, its effortless pull-on design ensures you're always ready to tackle whatever the day throws your way.

-

Besnard - Made to Order Trousers - $351 Design your ideal pair of trousers by selecting a fabric, deciding between single or double pleats, choosing a zip or button fly, and opting for side adjusters or belt loops.

Latest posts

- Replies

- 8,093

- Views

- 1,592,822

- Replies

- 62,909

- Views

- 6,444,359

- Replies

- 81,636

- Views

- 14,015,755

- Replies

- 0

- Views

- 1

Similar threads

- Replies

- 1

- Views

- 6,238

- Replies

- 17

- Views

- 14,497

- Replies

- 297

- Views

- 50,427

- Replies

- 17

- Views

- 3,888

Featured Sponsor

Forum Sponsors

- American Trench

- AMIDÉ HADELIN

- Archibald London

- The Armoury

- Arterton

- Besnard

- Canoe Club

- Capra Leather

- Carmina

- Cavour

- Crush Store

- De Bonne Facture

- Drinkwater's Cambridge

- Drop93

- eHABERDASHER

- Enzo Custom

- Epaulet

- Exquisite Trimmings

- Fils Unique

- Gentlemen's Footwear

- Giin

- Grant Stone

- House of Huntington

- IsuiT

- John Elliott

- Jonathan Abel

- Kent Wang

- Kirby Allison

- Larimars Clothing

- Lazy Sun

- LuxeSwap

- Luxire Custom Clothing

- Nicks Boots

- No Man Walks Alone

- Once a Day

- Passus shoes

- Proper Cloth

- SARTORIALE

- SEH Kelly

- Self Edge

- Shop the Finest

- Skoaktiebolaget

- Spier and MacKay

- Standard and Strange

- Bespoke Shoemaker Szuba

- Taylor Stitch

- TLB Mallorca

- UNI/FORM LA

- Vanda Fine Clothing

- Von Amper

- Wrong Weather

- Yeossal

- Zam Barrett

Members online

- Friend

- VaderDave

- gazeai999

- Poomba

- Fenderplyr

- TechNik

- ModWar

- norsefanboi

- ramdomthought

- grs

- furiogiunta

- jj02138

- gonnagetmine

- haggis

- Shen

- boyoi

- jiredell

- beowolf

- Jalen

- PGS

- BerryWall

- florent

- SalmanBaba

- CasualWearer88

- kakishiboo

- aKula

- Wim

- stook1

- classicalthunde

- Jr Mouse

- TheLawBeard

- jellyroller

- Conclusive

- Mr SHIFTY

- #dadcore

- TomHopke

- jorgeragula05

- garigo

- MJMcRibb

- SanLucca1877

- Thin White Duke

- Dino944

- metals37

- MotionInReverse

- owenshill

- sacragon

- stafa

- Jpto

- DapperPhilly

- Ambulance Chaser

Total: 2,230 (members: 127, guests: 2,103)