bry2000

Stylish Dinosaur

- Joined

- Oct 22, 2004

- Messages

- 10,039

- Reaction score

- 8,998

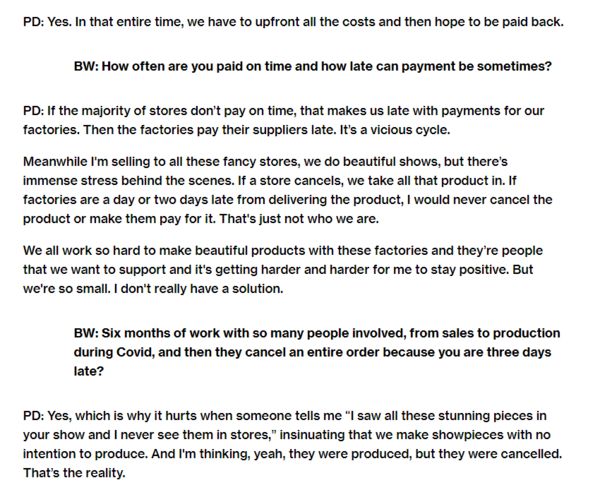

\Uh what? This model of a smaller fixed + higher variable rent is prevalent in Asia, particularly HK and China.

the premise we started with was no fixed, all variable.